When one spouse is the “money person” in the relationship, it can create issues in both life and death. To avoid unnecessary stress, couples need to ensure that they are on the same page. For day-to-day finances, this can mean regular check-ins about charges, expenditures, and budgeting. About estate planning, couples should keep each other informed about the location of important documents such as the following:

Category Archives: Estate Planning

Payable on death and transfer on death sound ominous; and while the topic of death is always somewhat gloomy, POD and TOD are estate planning terms that financial account holders should be familiar with.

The first step is to figure out what accounts the deceased had by looking through their mail, email, or phone notifications. You may get lucky, as the deceased may have compiled a list as part of their estate plan. Once you have identified what accounts were in the deceased’s name, you can move on to the next step of deciding whether to cancel or keep them.

It is understandable why people do not want to talk or think about death. But dying without a will takes power out of the individual’s hands and puts it in the hands of the state and its one-size-fits-all intestacy laws. Here is the law in California, where Skvarna Law Firm is located:

Unless someone carefully declutters throughout their entire lifetime, it is unlikely that they will die without possessions. What’s more, when someone struggles at the end of their life with an ailment or age-related decline, they may require certain medical items:

Founded in 1998, PayPal was not the first company to offer online payments, but it was the first to obtain widespread adoption and is the top payment application among Americans today, with around three out of four respondents saying they are active users.

This person is a trusted decision maker who is tasked with handling all matters that relate to your trust. Depending on the type of trust, you could be the trustee in the beginning and need someone else to act as trustee only when you are unable to manage the trust, or you could select a trustee to act immediately.

In more recent years, states simplify probate procedures. For example, the Uniform Probate Code (UPC) consists of laws written by a group of national experts. As such, it helps to standardize and streamline probate. As a result, most states have adopted these standards. Across state lines, the probate process generally works more effectively.

Seek out resources if you lost your job through no fault of your own. Some employers offer severance packages. And in many cases, you could collect unemployment benefits. Depending on state law and your former employer’s policy, a payout of accrued vacation and sick leave may fund source of liquidity to sustain you for a while.

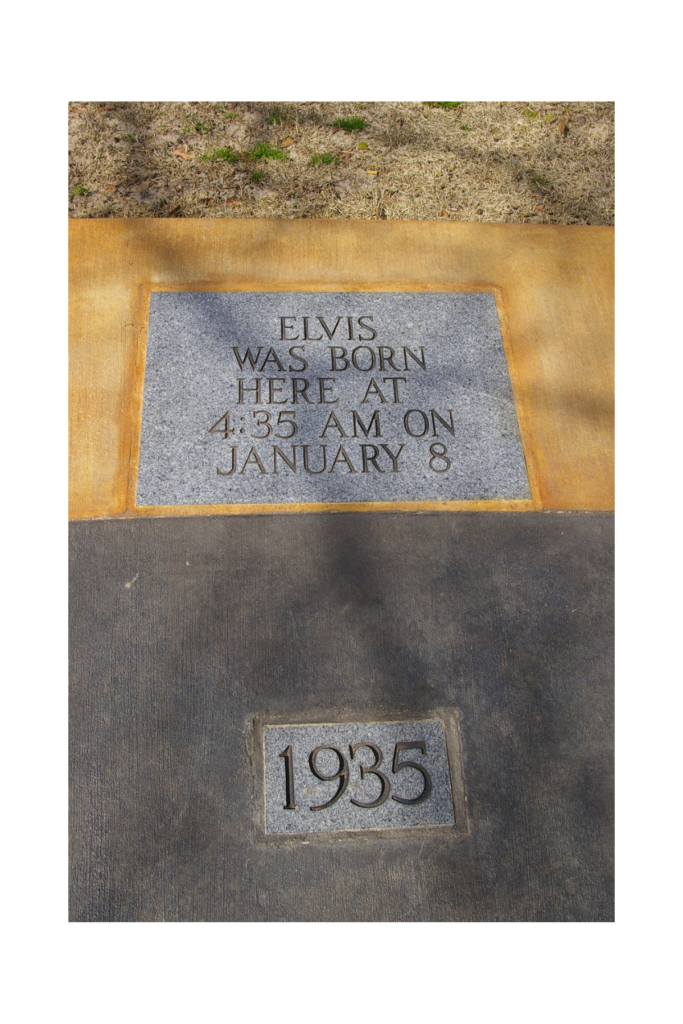

Born in 1968 to Elvis and Priscilla Presley, Lisa Marie followed in the footsteps of her father as far as heart trouble. While her father died from a heart attack at the age of 42, she died due to heart problems nearly 46 years later, in January 2023.