Although a large amount of her wealth came from her marriage to the late billionaire financier Richard C. Blum, Senator Feinstein was also successful in her own right. During their marriage, Feinstein and Blum established a marital trust that is now the subject of a fierce legal battle between Feinstein’s daughter and Blum’s three daughters.

Category Archives: Celebrity Estates

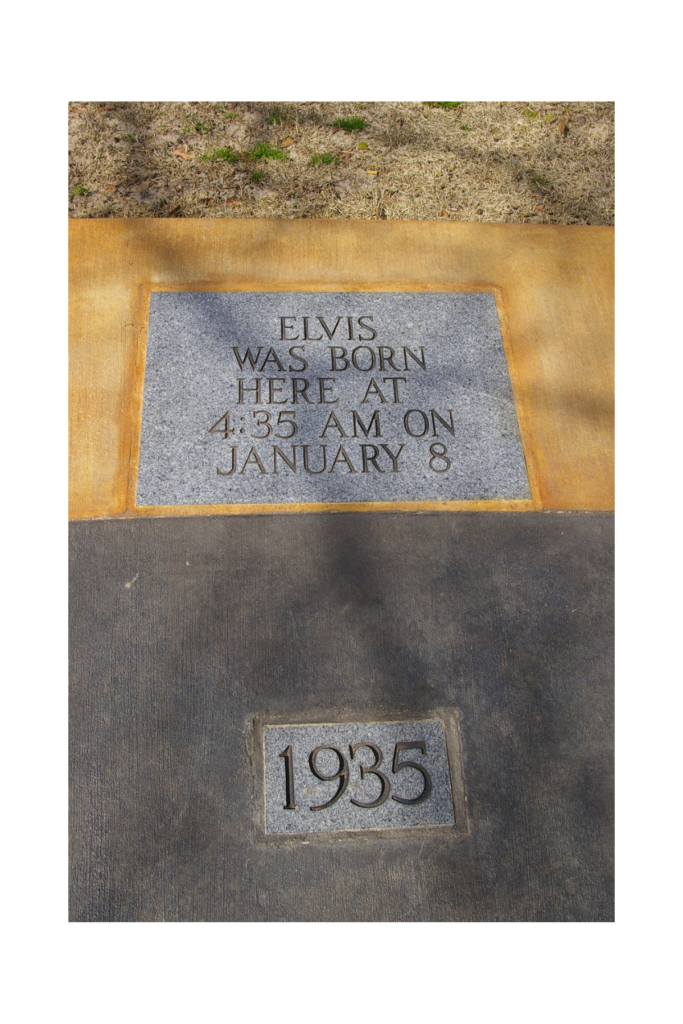

Born in 1968 to Elvis and Priscilla Presley, Lisa Marie followed in the footsteps of her father as far as heart trouble. While her father died from a heart attack at the age of 42, she died due to heart problems nearly 46 years later, in January 2023.

Raquel Welch had a reported net worth of $40 million. This will presumably go to her two adult children. However, few details reveal Welch’s estate plan. This suggests that she was also savvy about estate planning.

Who would care for your pet if you die or somehow face incapacitation? Would your survivors know how to give your pet the same level of care you provide? A good way to ensure your pet is well cared for if something happens to you is to create a pet trust.

Aaron Carter failed to achieve the stardom of his older brother Nick. Nevertheless, he succeeded as a performer in his own right. He opened for the Backstreet Boys at age nine.

When creating a trust, you can include specific provisions in your trust agreement that will either encourage or discourage certain kinds of behavior.

Normally, somebody in the will specifies an administrator (a person who oversees settling of the estate).

Bruce Wayne possess something key to moonlighting as Batman: money. Heir to an enormous fortune, Wayne emerges as one of Gotham’s wealthiest citizens. A major philanthropist who donates money to various causes, neither role would work without assets.

Blended families challenge us in life and death. Someone with children from a previous marriage balances wanting to provide for their children and their spouse. Specifically, concerns arise relative to the money left to the current spouse.

Using a bypass trust is another way to avoid the estate tax. In this case, Meat Loaf could have created a trust to hold an amount equal to his unused individual lifetime exclusion amount ($12.06 million), with any excess passing to his wife either outright or through a marital trust, therefore bypassing estate tax liability.

- 1

- 2