Founded in 1998, PayPal was not the first company to offer online payments, but it was the first to obtain widespread adoption and is the top payment application among Americans today, with around three out of four respondents saying they are active users.

This person is a trusted decision maker who is tasked with handling all matters that relate to your trust. Depending on the type of trust, you could be the trustee in the beginning and need someone else to act as trustee only when you are unable to manage the trust, or you could select a trustee to act immediately.

In more recent years, states simplify probate procedures. For example, the Uniform Probate Code (UPC) consists of laws written by a group of national experts. As such, it helps to standardize and streamline probate. As a result, most states have adopted these standards. Across state lines, the probate process generally works more effectively.

If you are in a long-term relationship with your partner but remain unmarried, you may want to take advantage of these benefits. However, joint trusts do not work for unmarried couples. This may not seem fair. However, there are some important reasons why unmarried couples should consider separate rather than joint trusts.

Seek out resources if you lost your job through no fault of your own. Some employers offer severance packages. And in many cases, you could collect unemployment benefits. Depending on state law and your former employer’s policy, a payout of accrued vacation and sick leave may fund source of liquidity to sustain you for a while.

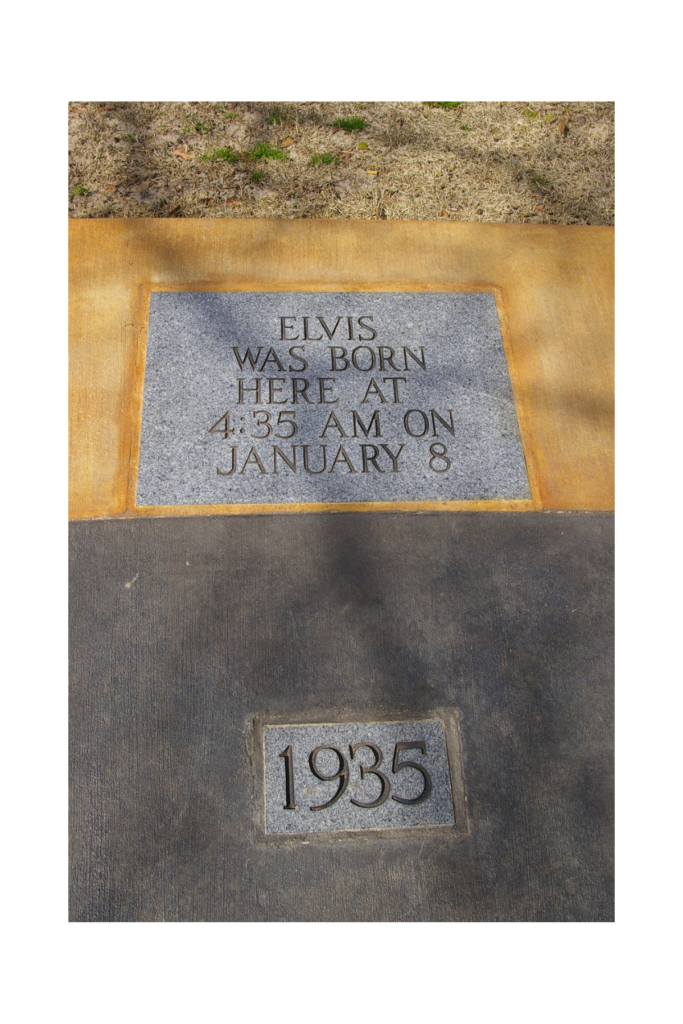

Born in 1968 to Elvis and Priscilla Presley, Lisa Marie followed in the footsteps of her father as far as heart trouble. While her father died from a heart attack at the age of 42, she died due to heart problems nearly 46 years later, in January 2023.

Even as the coronavirus pandemic wanes, many older adults remain socially isolated and vulnerable to financial victimization. Robocalls, emails scams, and catfishing on social media platforms, con artists bombard the elderly routinely seeking financial gain. However, the National Adult Protective Services Association (NAPSA) reports that most financial exploitation cases the organization receives are from individuals known to the victims, such as relatives, caregivers, friends, and neighbors.

Military personnel are entitled to a host of benefits that can significantly impact estate planning. These include pensions, healthcare benefits, survivor benefits, and life insurance programs. These benefits, when properly incorporated into an estate plan, can provide a significant financial safety net for the service member’s family.

Between planning, permitting, and construction, the home remodeling process can take months to complete. But even after the finishing touches have been applied, you may still have work to do. If the home is part of an estate plan, a remodel can affect that plan and require changes to it. To keep your estate plan up to date, make sure to discuss a home remodeling project with an attorney.

When creating your estate plan, decide who to assign as your beneficiaries. These are the individuals who will inherit your money and property when you pass away. Beneficiaries often include a spouse or partner, children and stepchildren, grandchildren, other relatives, friends, charitable organizations, and/or a church.