If you are not sure whether an irrevocable trust is still a good fit or if you wonder whether you can benefit more from your trust, we are happy to meet with you so we can analyze your current trust. Perhaps modifying or terminating your irrevocable trust is a good option. Making that determination simply requires a conversation about your goals and a review of the trust itself. Please call our office now to schedule time to review your current trust or discuss the potential benefits that a trust can provide to address your unique situation and goals.

Category Archives: Trusts

In September 2022, Yvon Chouinard, the founder of Patagonia, a $3 billion clothing company, transferred the voting stock of the company to a purpose trust designed to further his lifelong goal of fighting the environmental crisis. In a message from Chouinard on Patagonia’s website, he explained that his desire was for the company to continue to pursue its stated purpose: “We’re in business to save our home planet.”

A grantor retained annuity trust (GRAT) is an irrevocable grantor trust you can use to make large financial gifts to your loved ones while also minimizing gift tax liability. These financial gifts remove future appreciation from your estate, reducing the amount that will be subject to estate tax at your death. However, gift tax liability could apply. In this case, the trust creator would pay at the onset. You create a GRAT and then fund it with accounts and property. People expect these to appreciate over the GRAT’s term. Then, you receive a fixed annuity payment, based on the trust’s original value, for a specified time. Once the period ends, the court transfers the remainder of the trust’s accounts and property to your named beneficiary.

Unless someone carefully declutters throughout their entire lifetime, it is unlikely that they will die without possessions. What’s more, when someone struggles at the end of their life with an ailment or age-related decline, they may require certain medical items:

This person is a trusted decision maker who is tasked with handling all matters that relate to your trust. Depending on the type of trust, you could be the trustee in the beginning and need someone else to act as trustee only when you are unable to manage the trust, or you could select a trustee to act immediately.

If you are in a long-term relationship with your partner but remain unmarried, you may want to take advantage of these benefits. However, joint trusts do not work for unmarried couples. This may not seem fair. However, there are some important reasons why unmarried couples should consider separate rather than joint trusts.

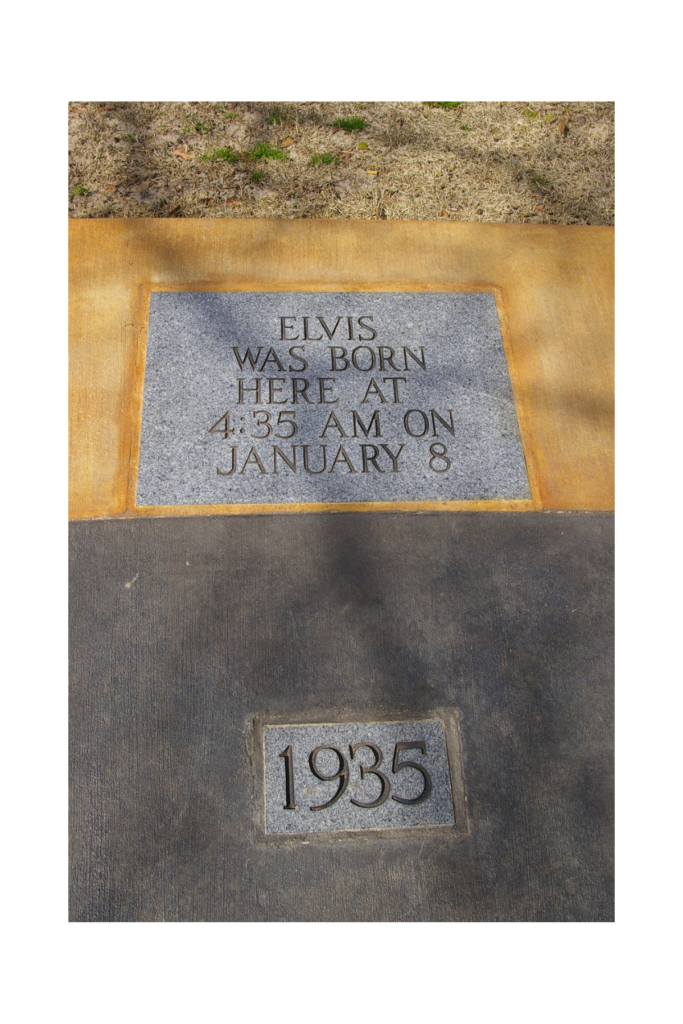

Born in 1968 to Elvis and Priscilla Presley, Lisa Marie followed in the footsteps of her father as far as heart trouble. While her father died from a heart attack at the age of 42, she died due to heart problems nearly 46 years later, in January 2023.

Military personnel are entitled to a host of benefits that can significantly impact estate planning. These include pensions, healthcare benefits, survivor benefits, and life insurance programs. These benefits, when properly incorporated into an estate plan, can provide a significant financial safety net for the service member’s family.

Between planning, permitting, and construction, the home remodeling process can take months to complete. But even after the finishing touches have been applied, you may still have work to do. If the home is part of an estate plan, a remodel can affect that plan and require changes to it. To keep your estate plan up to date, make sure to discuss a home remodeling project with an attorney.

Raquel Welch had a reported net worth of $40 million. This will presumably go to her two adult children. However, few details reveal Welch’s estate plan. This suggests that she was also savvy about estate planning.