5 Things Every New Parent Needs to Know About Wills as the New Year Begins The New Year often marks a season of reflection, intention, and planning. For new parents, that sense of responsibility deepens quickly. A new baby changes priorities overnight. Decisions that once felt optional now feel essential, especially when thinking about your […]

Category Archives: Taxes

A Holiday-Season Guide to Understanding Estate and Inheritance Death Taxes As the holiday season arrives, families travel, gather around busy tables, and spend more time thinking about the people they love. This time of year also brings a noticeable rise in deaths nationwide. As sad as that is, medical researchers consistently note a winter “uptick” […]

If you are in a long-term relationship with your partner but remain unmarried, you may want to take advantage of these benefits. However, joint trusts do not work for unmarried couples. This may not seem fair. However, there are some important reasons why unmarried couples should consider separate rather than joint trusts.

Although starting a business is a significant achievement, small business owners cannot coast on past accomplishments. You must look to the future and plan next steps.

Do you still own the same property or have the same account balances as when your plan was first created? What will the balances be like at your death?

Before asset distribution, the estate’s executor should make every effort to pay all outstanding debts. After bills are paid, and the remaining assets are accounted for.

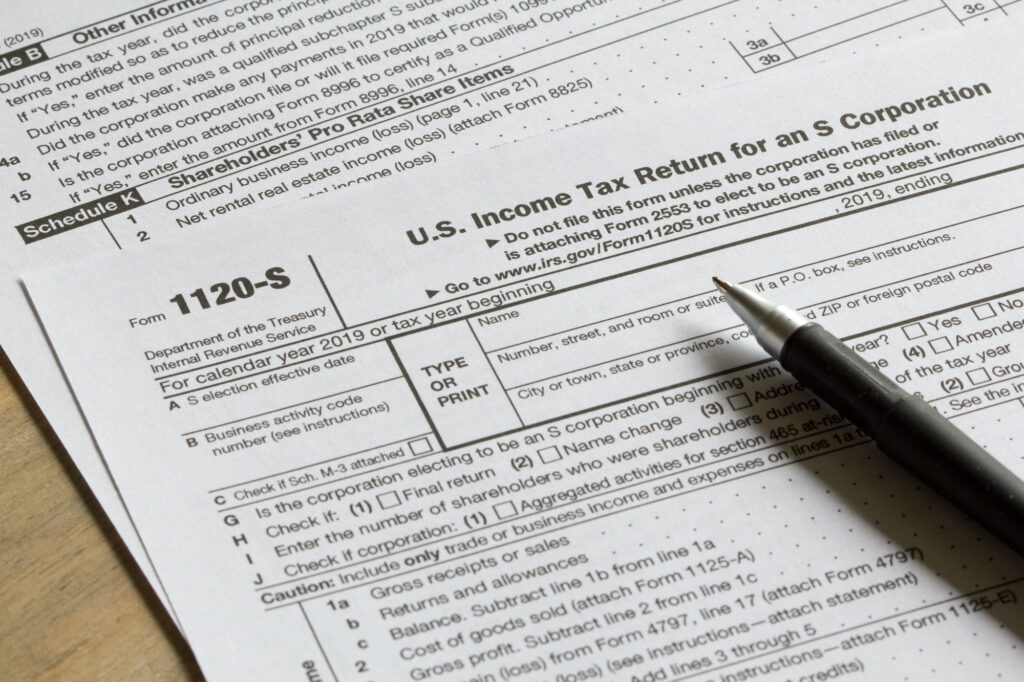

The Internal Revenue Service (IRS) describes S corporations as “corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes.”

An annual itemized deduction is available for payment of state and local property, income, and sales taxes. This deduction cannot exceed $10,000, however.

Using a bypass trust is another way to avoid the estate tax. In this case, Meat Loaf could have created a trust to hold an amount equal to his unused individual lifetime exclusion amount ($12.06 million), with any excess passing to his wife either outright or through a marital trust, therefore bypassing estate tax liability.

People overlook many of these tasks and responsibilities on a day-to-day basis. However, consider how much money or time you would need to complete them if the stay-at-home parent is unable?