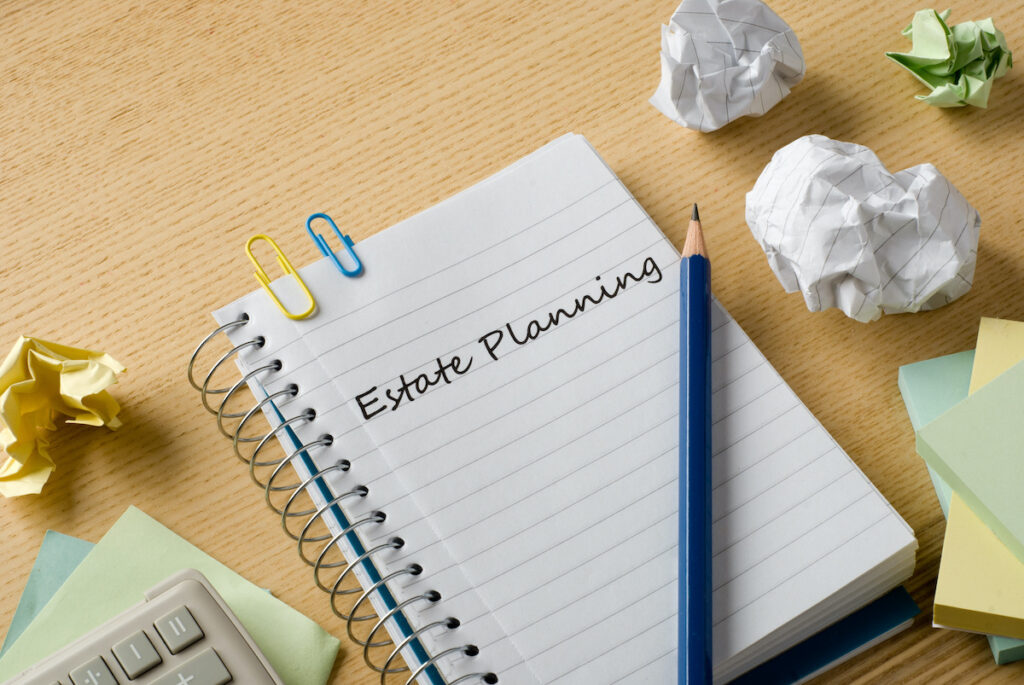

Estate Planning Strategies to Protect Your Spouse In recent posts, we’ve discussed topics such as divorce and estate planning as well as disinheriting a spouse. This week, let’s focus on what you can do to protect your spouse in estate planning. Marriage legally positions you to provide long-term financial security for your spouse through legal […]

Category Archives: Estates

Estate planning doesn’t just reflect what you have today—it anticipates what tomorrow might bring. For many in Glendora and Upland, this means preparing for the unexpected: incapacity, sudden illness, or death. For parents and parents-to-be, the question of whether to include future children in an estate plan often surfaces. Does planning for a child who […]

Planning for the future complicates life. This is especially true if you want to make sure that a loved one continues living comfortably after you die. Two common tools for accomplishing this are life estates and right of occupancy trusts. A life estate grants someone the legal right to live in a home for the rest of their […]

These words, uttered by James Earl Jones in his voice-over role as Darth Vader, are indelible in the minds of Star Wars fans. People know Jones also for voicing Mufasa in The Lion King and a series of cable news promotions in which he declared, “This is CNN.”

As we get older, it is inevitable that we become more aware of our mortality. Reflections on life and death do not necessarily have to be morbid. They can also prompt us to take actions that focus on our legacy. Caring.com found that, in 2024, 43 percent of adults over age 55 have wills—down from 46 percent in 2023 and 48 percent in 2020

Create your first estate plan in a way that won’t lock you into the plan for the rest of your life. The following are common changes we can make to your estate plan to ensure that we adequately address your evolving concerns and wishes.

One option to financially provide for your pet is to give a lump sum to the person you choose to care for your pet at your death. This option is the easiest to carry out and does not involve any ongoing administration or oversight. However, because the money goes directly to the caregiver, there will be no one monitoring the use of the funds. You must trust that the caregiver will use the funds for the pet’s benefit.

When someone is unable to manage his or her own affairs – often due to illness or older age – family members may seek court intervention to appoint a conservator or guardian. The court-appointed individual makes financial decisions on behalf of the incapacitated person. The same person (or sometimes someone different, also appointed by the court) takes over control of everyday matters, including medical decisions. These living probate proceedings are public, time-consuming, and expensive.

Although a large amount of her wealth came from her marriage to the late billionaire financier Richard C. Blum, Senator Feinstein was also successful in her own right. During their marriage, Feinstein and Blum established a marital trust that is now the subject of a fierce legal battle between Feinstein’s daughter and Blum’s three daughters.

As trust beneficiaries die and younger generations become the new heirs, vague provisions or outright mistakes in the original trust agreement may become apparent. Decanting can be used to correct these problems.