If you become incapacitated, who is going to take care of you? As difficult as it may be, face facts. If you become incapacitated, you will not be able to make medical decisions for yourself. What’s more, you won’t be able to manage day-to-day-today affairs. This would be sad no matter what. But, if you do not have the appropriate estate plan in place, chaos could ensue. In fact, your family could be headed to probate court long before you are deceased. A Living Probate refers to conservatorship or guardianship proceedings. Some refer to it as a Living Nightmare. But never fear. If your situation calls for a probate, we can help.

Here is how to eliminate your risk:

Conservatorship or Guardianship Proceedings

When someone is unable to manage his or her own affairs – often due to illness or older age – family members may seek court intervention to appoint a conservator or guardian. The court-appointed individual makes financial decisions on behalf of the incapacitated person. The same person (or sometimes someone different, also appointed by the court) takes over control of everyday matters, including medical decisions. These living probate proceedings are public, time-consuming, and expensive.

When someone is unable to manage his or her own affairs – often due to illness or older age – family members may seek court intervention to appoint a conservator or guardian. The court-appointed individual makes financial decisions on behalf of the incapacitated person. The same person (or sometimes someone different, also appointed by the court) takes over control of everyday matters, including medical decisions. These living probate proceedings are public, time-consuming, and expensive.

Avoiding Living Probate

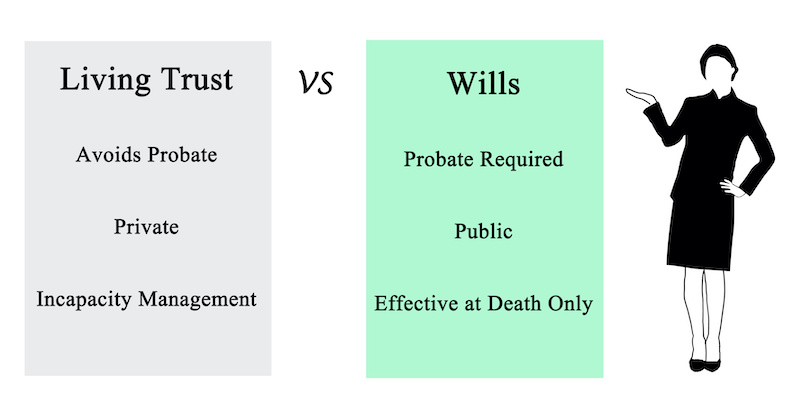

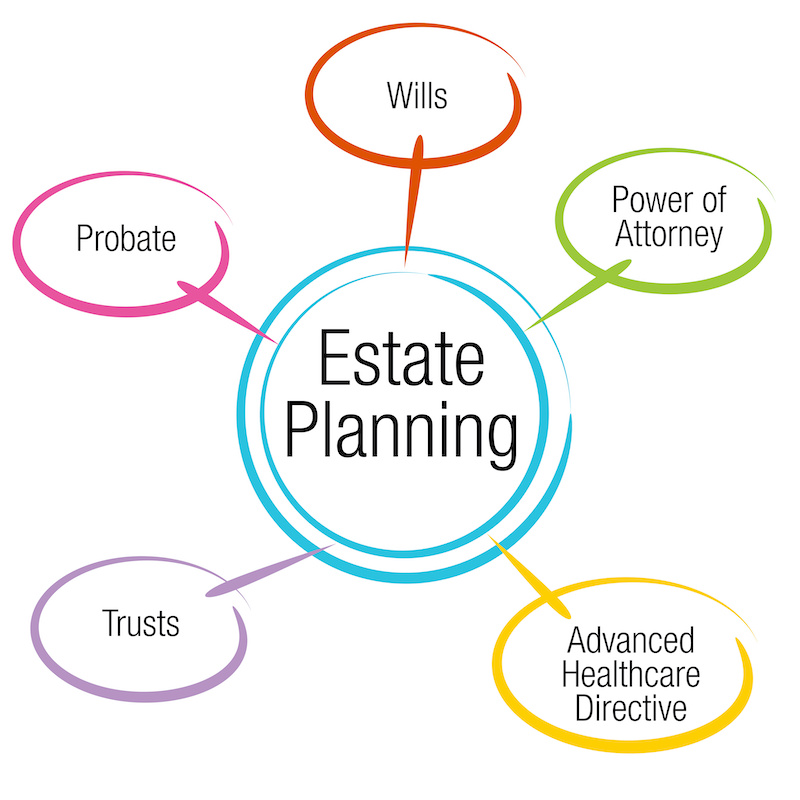

While several ways exist to avoid living probate, the best way is quite simple. Plan beforehand by appointing someone to handle your estate planning matters while you remain “of sound mind.” This includes putting together a medical Power of Attorney (POA) to designate an individual you would like to make medical decisions on your behalf. Likewise, a financial POA designates an individual to make financial decisions. You can appoint the same person for both roles and different individuals. The choice is yours. Some financial institutions provide specific forms that must be completed if you choose to designate someone to access your account on your behalf. Check with your bank or credit union for specifics.

Seek Estate Planning Professionals for Living Probate

Since time is of the essence when dealing with medical or financial issues, work with your estate planning attorney to assemble and prepare the documents necessary to facilitate transactions in your absence. An experienced estate planning attorney can help guide you through this process and draft documents which follow all applicable formalities.

About Skvarna Law Firm in Upland and Glendora, California

A skilled attorney can assist with your estate plan. Contact us today to learn about your options (909) 608-7671. We operate offices in Glendora and Upland, California. We provide legal services for individuals living in San Bernardino, Los Angeles, Orange and Riverside Counties. This includes the cities of Upland, Ontario, Rancho Cucamonga, Fontana, Colton, Rialto, Chino, Chino Hills, Glendora, Claremont, Montclair, Pomona, La Verne, San Dimas, Azusa, Covina, West Covina, Diamond Bar, Walnut, La Puente, Corona, Norco & Mira Loma. Visit SkvarnaLaw.com to learn more.