Given Snow White’s young age when her father passed, it is likely that she was too young to manage a large sum of money or rule a kingdom without some guidance and oversight. Therefore, whatever he wanted to leave behind for Snow White could have been held in trust for her, either under his will as a testamentary trust or as a sub-trust of his revocable living trust. A trust would have allowed him to craft specific instructions on when and how Snow White would receive her inheritance. If the king created a separate sub-trust for Snow White, he could provide instructions so Snow White would receive her inheritance when the king died instead of waiting until her stepmother passed away to receive whatever was left over.

Category Archives: Estate Administration

In movies and television shows, there is often a dramatic scene where family members gather in a lawyer’s office for the reading of the will. The atmosphere is usually tense, and everyone is eagerly waiting to find out who gets what.

As part of the estate planning process, you should discuss with your attorney the role they will play during your lifetime and whether they can also assist your loved ones with estate and trust administration when you pass away.

As trust beneficiaries die and younger generations become the new heirs, vague provisions or outright mistakes in the original trust agreement may become apparent. Decanting can be used to correct these problems.

A conservatorship is a court-ordered arrangement that gives one person (or multiple people), called a conservator, legal authority to manage the affairs of another person, known as a conservatee or ward. Conservatees are often children. Incapacitated adults and those with developmental or age-related disabilities often enter conservatorship.

A husband may move out of the home he shared with his wife and have limited or no contact with her or their children. An abused child who lives with a relative may avoid contact with their parent. A parent may choose not to associate with a child who has committed crimes or abused their trust. These types of situations are unfortunate and occur more often than we would like. Limited contact, or even the absence of any contact, fails to majorly impact the legal right of an estranged spouse or child to inherit from their family member. This is especially true if no estate plan expresses an intention to disinherit them.

A grantor retained annuity trust (GRAT) is an irrevocable grantor trust you can use to make large financial gifts to your loved ones while also minimizing gift tax liability. These financial gifts remove future appreciation from your estate, reducing the amount that will be subject to estate tax at your death. However, gift tax liability could apply. In this case, the trust creator would pay at the onset. You create a GRAT and then fund it with accounts and property. People expect these to appreciate over the GRAT’s term. Then, you receive a fixed annuity payment, based on the trust’s original value, for a specified time. Once the period ends, the court transfers the remainder of the trust’s accounts and property to your named beneficiary.

Unless someone carefully declutters throughout their entire lifetime, it is unlikely that they will die without possessions. What’s more, when someone struggles at the end of their life with an ailment or age-related decline, they may require certain medical items:

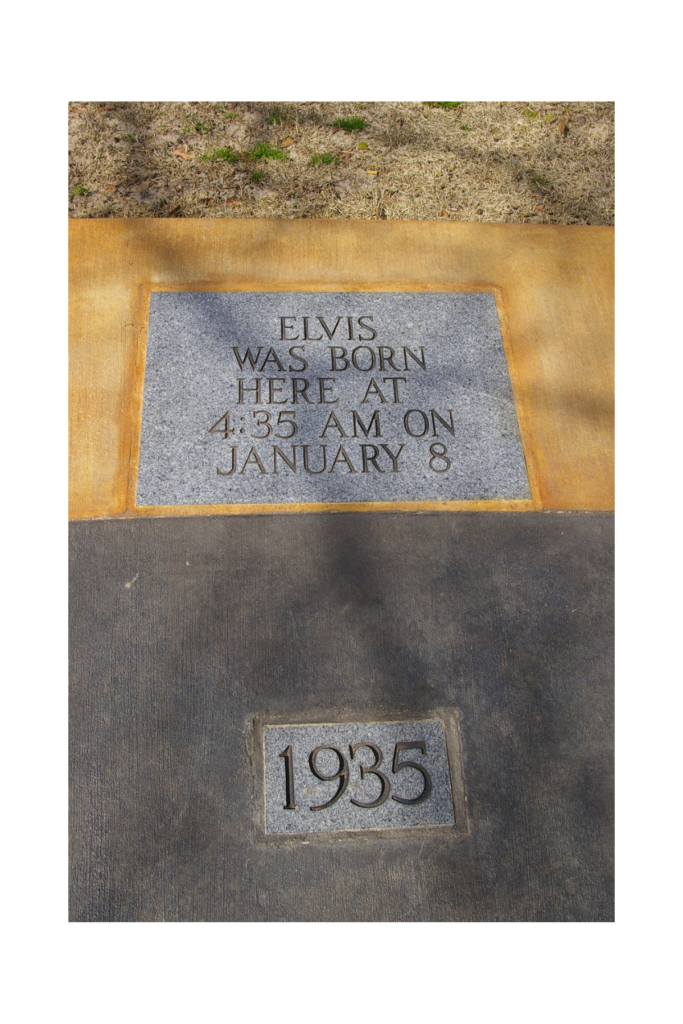

Born in 1968 to Elvis and Priscilla Presley, Lisa Marie followed in the footsteps of her father as far as heart trouble. While her father died from a heart attack at the age of 42, she died due to heart problems nearly 46 years later, in January 2023.

Complex probate processes can be costly and take years to finalize, which is why many individuals retain an estate planning attorney to minimize probate proceedings.