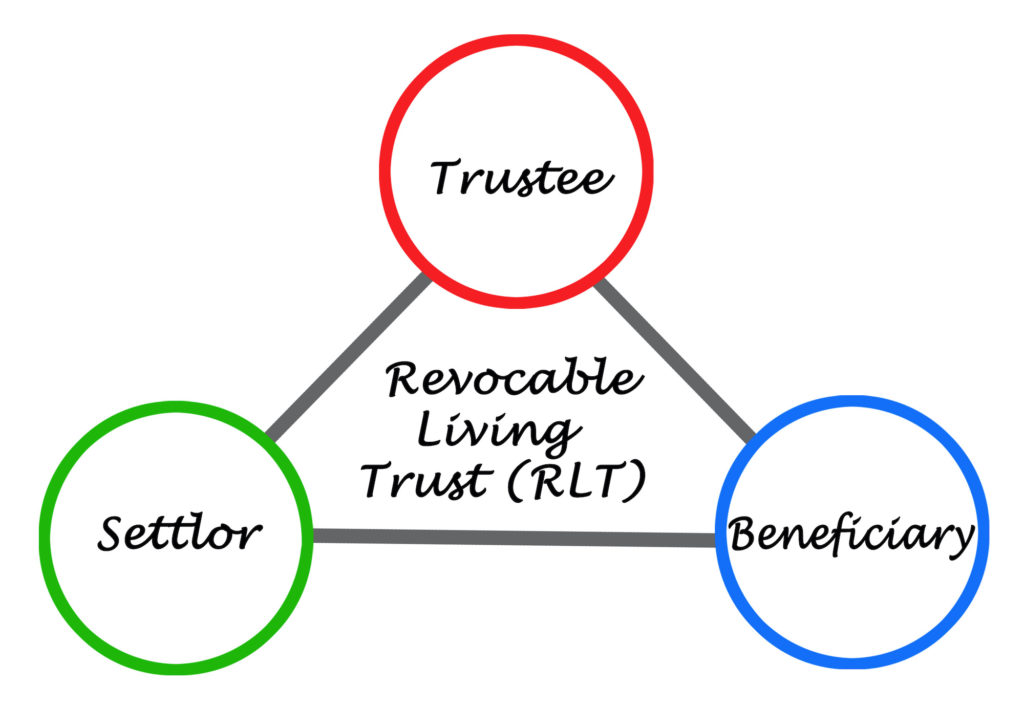

Name someone to serve with you. This familiarizes your co-trustee with your trust. It also teaches your partner about the way you want the trust to operate. What’s more, it lets you evaluate your co-trustee’s abilities.

Category Archives: California Law

Busy as ever, many of us supervise kids (in-person or virtually), pursue new employment opportunities and/or adapting to new work environments. What’s more, most of us are adjusting savings and investment goals.

Chadwick Boseman died at the age of 43, after a four-year battle with colon cancer. Boseman kept his cancer diagnosis a secret for four years, working on projects such as the Black Panther in the Marvel Comics Avengerfilm franchise.

Unfortunately, accidents happen to everyone. Moreover, even innocent accidents could lead to litigation and potential loss of personal wealth. A tool such as a DAPT may protect your property for your family, both now and in the future.

DAPT laws vary significantly by state. Residency requirements vary from state to state, as does the required connection of the grantor with the DAPT state.

To better assist our clients, we are available to meet by telephone or video conference. We may also be able to use remote procedures for the signing and executing of your documents, eliminating the need for you to come into our office at all.

If you do not appoint the custodian, the court will appoint someone to control and manage your children’s inheritance until they reach a pre-set age of majority. This is necessary because minors legally cannot own money or property on their own.

Supporting a special needs child or grandchild can be expensive. While you are working or have a stream of income, you can allocate money as you see fit.

Part 3 of a 3-Part Series Last week, in part two of our three-part post about probate-proof estates, we covered one option for avoiding probate with a strategy we called the “Piecemeal Approach.” Click here to read that post. And to catch up by reading part one, which introduced the concept of how to avoid […]

The Smartest Way to Make Sure Your Estate Plan is Probate-Proof First in a 3-Part Series Consider this important question: When did you and your estate planning attorney perform a full review of the following? Your long-term plans for your financial affairs Family Legacy? For that matter, have you ever sought out such a review? […]