How to Protect Your Family from Lawsuits

Part 1 of a 2-Part Series

Family, friends, and colleagues regularly discuss topics such as lawsuits, divorces, bankruptcies, and other threats. But few broach the subject relative to how these put property at risk of loss to a creditor. Such conversations leave most people shaking their heads. They wonder aloud world is coming to. Discussing the harsh reality leaves most feeling vulnerable and frustrated. However, a readily available tool (even those of modest means) protects property from such threats. What’s more, reasonably priced Domestic Asset Protection Trusts (DAPT) demands relatively few hoops through which to jump.

What are Domestic Asset Protection Trusts (DAPTs)?

Domestic Asset Protection Trusts (DAPT) enables a grantor or trust-maker to transfer accounts and property. Consider assets such as your home, cash, stocks, or other investments. Assets legally transferred into the DAPT guard against future lawsuits, divorcing spouses, bankruptcies or creditors, and similar threats. Nevertheless, after you transferred these accounts and property to the trust, you can continue to enjoy the benefits of DAPT property (with minor limitations).

DAPTs work on the legal principle that one cannot take away something someone no longer owns. When you transfer ownership of your property to a DAPT, you make a gift of it to the trustee. The trustee is the person or entity you choose to manage, invest, and use the accounts and property) on behalf of the irrevocable trust. The trustee becomes legally obligated to use this property for your benefit. Or, they use it for the benefit of those named in the trust.

How Domestic Asset Protection Trusts Works

When you create a DAPT, you sign a trust document. In it, you permanently gift some of your property into the trust. Such trusts are irrevocable. In other words, they do not allow you to alter the trust agreement. The document creating the trust establishes the rules that control the trust. The trustee makes distributions to the grantor, thereby allowing you to continue enjoying some benefits of the property in the trust. However, most trustees function as independent trustees. This means someone unrelated or subordinate will not inherit anything from the trust. This preserves the asset protection properties of the trust. Still, many states allow for a grantor to serve a co-trustee. They may also exercise authority with respect to the investment decisions of the trust.

States & DAPT Laws

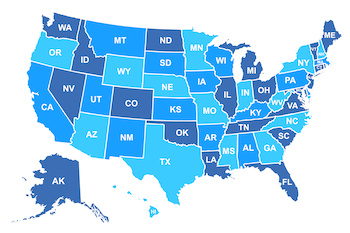

Currently, the following states legislate creations of a DAPT:

- Alaska

- Connecticut

- Delaware

- Hawaii

- Indiana

- Michigan

- Mississippi

- Missouri

- Nevada

- New Hampshire

- Ohio

- Oklahoma

- Rhode Island

- South Dakota

- Tennessee

- Utah

- Virginia

- West Virginia

- Wyoming

DAPT laws vary significantly by state. Residency requirements vary from state to state, as does the required connection of the grantor with the DAPT state. In some instances, you can live in one state but maintain a DAPT in a different state. Some DAPT laws are better than others. And their effectiveness depends on the location of the property gifted into the trust. Given these considerations, speak with an experienced estate attorney when setting up a DAPT.

Key differences in state law which significantly impact the effectiveness of a DAPT:

- How to set up a DAPT

- Who can serve as the trustee

- How much property can be placed in the trust

- Which creditors will be blocked from reaching the trust property

- What additional powers you, as the grantor, can exercise over the trust

- How much time must pass before the property placed in a DAPT is protected from creditors

Check back next week, when we conclude this two-part series.

About Skvarna Law in Glendora and Upland, California

Skvarna Law Firm operates offices in Glendora and Upland, California. We provide legal services. We cover San Bernardino, Los Angeles, Orange, and Riverside Counties. This includes several cities. Upland, Ontario, Rancho Cucamonga, Fontana, Colton, Rialto, Chino, Chino Hills, Glendora, Claremont, Pomona, La Verne, Montclair, San Dimas, Azusa, Covina, West Covina, Diamond Bar, Walnut, La Puente, Corona, Norco & Mira Loma. Visit SkvarnaLaw.com to learn more.