COVID-19 created economic upheaval for many. One result? Bankruptcy. If you declared Bankruptcy in 2021, do you wonder about next steps? To protect your remaining accounts and property as well as yourself and loved ones, consider an estate plan as a roadmap into the future.

Protecting Your Money and Property

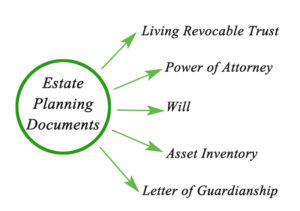

Whether you filed for Chapter 7 or Chapter 13 bankruptcy, assume that you own less money and property than before the bankruptcy. However, during the bankruptcy process, the court reports certain accounts and pieces of property under a federal or state exemption. Protect the value of these assets through a proper estate plan. Include these elements:

Beneficiary Designations after Bankruptcy

For accounts or policies retained after bankruptcy (such as a life insurance policy or retirement account), complete beneficiary designations. Failing to complete these forms will leave money paid to your estate. This will necessitate a costly and time-consuming probate process. Or it may go to individuals according to the order outlined in the governing agreement. In addition, going through probate may subject retirement accounts to unintended income tax consequences.

Last Will and Testament

In this document, also called a will, name a personal representative or executor. An executor collects accounts and property, pays outstanding debts, and distributes the money and property to those named. Specify who to distribute accounts and property at your death. And name a guardian for minor children. A will requires loved ones go through probate.

Revocable Living Trust (RLT) in a Bankruptcy

- With this trust created during your lifetime, you name yourself as the current trustee. What’s more, you designate a co-trustee or successor trustee to serve if you cannot act for any reason. During your lifetime, you change ownership from yourself as the trustee and designate the trust as the beneficiary of your accounts and property. In this way, you retain the property and serve as the trust’s beneficiary. The trust agreement outlines how to use the money and property during your life. With this document, management of the trust’s money and property occurs outside of probate. Note that an RLT does not provide asset protection benefits.

Caution

Before changing ownership of any accounts or property, close the bankruptcy proceeding. The court may deem transferring accounts or property during proceedings as fraudulent.

Additional Bankruptcy Protections Provided by an Estate

While planning for death usually motivates people to create an estate plan, we also focus on planning in cases of incapacitation. Consider the following serious questions. If you fail to select the people you want to fill these roles, a judge will select someone based on state law. They may not be who you would have chosen.

- Who will make financial and medical decisions if you are unable?

- What are your wishes regarding end-of-life care?

- What medical treatment do you want if you are diagnosed with a terminal illness or face a persistent vegetative state?

- Who would care for your minor children?

Facing bankruptcy is stressful. Thus, we would love to help you start life after bankruptcy on the right foot. You can do this by protecting your money and property. Call to discuss ways we can help you customize an estate plan to meet your unique objectives.

About Skvarna Law in Glendora & Upland, California

Skvarna Law Firm operates offices in Glendora and Upland, California. Also, we provide legal services. We cover San Bernardino, Los Angeles, Orange, and Riverside Counties. This includes several cities. Upland, Ontario, Rancho Cucamonga, Fontana, Colton, Rialto, Chino, Chino Hills, Glendora, Claremont, Pomona, La Verne, Montclair, San Dimas, Azusa, Covina, West Covina, Diamond Bar, Walnut, La Puente, Corona, Norco & Mira Loma.