Part 2 of a 2-Part Series

Last week, we began a two-part series, covering the top 10 most common types of trusts. This week, we conclude our series by focusing on #s 6-10. To read part one, click here.

Grantor Retained Annuity

A grantor retained annuity trust provides you with an annuity for a specific amount of time. People base the time on the value of the property in the trust. And, upon completion of the annuity period, remaining money and property transfer to those the trust maker names. This type of trust is used to make large financial gifts to your loved ones. Thus, accounts or property grow at a higher rate than the annuity rate paid back to you.

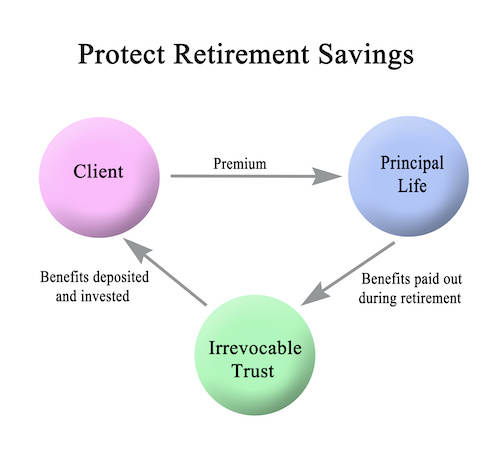

Irrevocable Life Insurance

Lawyers design an irrevocable life insurance trust to own high-value life insurance. Also, they set it up to make payment of the death benefit upon the trust-maker’s death. So, the plus side of this type of trust is that it excludes the life insurance proceeds from the deceased’s estate for tax purposes. However, it makes proceeds available to provide liquidity to pay taxes. And to equalize inheritances, fund buy-sell agreements, or provide an inheritance.

Marital Trusts

A marital trust protects the accounts and property for the surviving spouse’s benefit. They also qualify for the unlimited marital deduction. This excludes these accounts and pieces of property from estate tax at the first spouse’s death. However, it includes it in his or her estate for tax purposes.

Qualified Terminable Interest Property Trusts

A qualified terminable interest property trust initially provides income to the surviving spouse. And, when the surviving spouse dies, distributes remaining money and property to other named beneficiaries. Also, it simultaneously allows for the unlimited marital deduction. People commonly use these in second marriage situations. Or, to maximize estate and generation-skipping tax exemptions and tax planning flexibility.

Testamentary Trust

Lawyers create testamentary trusts in a will. They write this type of trust upon the individual’s death. Therefore, they do so to protect the money and property on behalf of a beneficiary. Thus, this is opposed to transferring money and property to the beneficiary outright. People can use it when a beneficiary is too young to manage their own money or property. Or, if they use drugs or face medical issues.

Or they may be incapable of responsibly managing their own money. Thus, the trust may provide asset protection from lawsuits. Or they can make a claim by a divorcing spouse brought against the beneficiary. So, this is unlike a revocable living trust or an irrevocable trust, wherein property should be transferred into a trust during the trust-maker’s lifetime. This works to protect property and avoid probate. Finally, testamentary trusts require the sometimes lengthy and expensive probate process before creating the trust.

In conclusion, many types of trusts exist. We will help you select which trusts, if any, are a good fit for you. Call today to schedule your in-person or virtual appointment. We are waiting to hear from you.

About Skvarna Law in Glendora and Upland, California

Skvarna Law Firm operates offices in Glendora and Upland, California. We provide legal services. We cover San Bernardino, Los Angeles, Orange and Riverside Counties. This includes several cities. Upland, Ontario, Rancho Cucamonga, Fontana, Colton, Rialto, Chino, Chino Hills, Glendora, Claremont, Pomona, La Verne, Montclair, San Dimas, Azusa, Covina, West Covina, Diamond Bar, Walnut, La Puente, Corona, Norco & Mira Loma. Visit SkvarnaLaw.com to learn more.