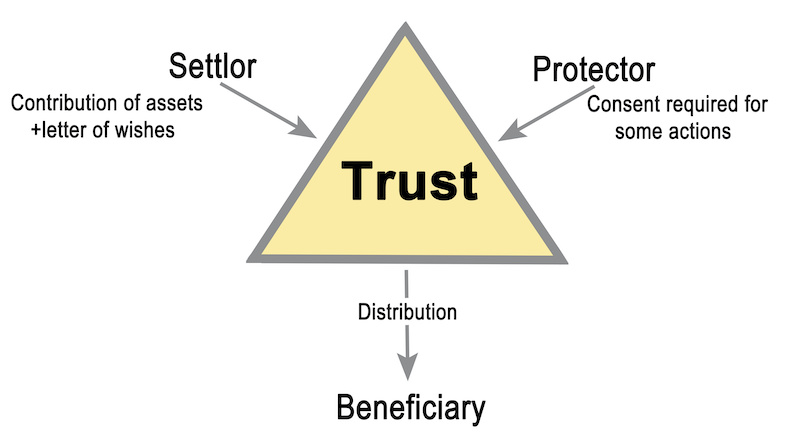

People across the United States use Trust Protectors. Essentially, a trust protector is someone who serves as an appointed authority over a trust which will be in effect for a long period of time. Trust protectors ensure that trustees maintain the integrity of the trust. What’s more, they make solid distribution and investment decisions, and adapt the trust to changes in law and circumstance.

Whenever changes occur, as they do, the trust protector modifies the trust to carry out the trustmaker’s intent. Significantly, the trust protector has the power to act without going to court—a key benefit that saves time and money and honors family privacy.

6 Ways a Trust Protector Can Help You

- Remove or replace a trustee who is not performing their duties appropriately or is no longer able or willing to serve.

- Amend the trust to reflect changes in the law.

- Resolve conflicts between beneficiaries and trustees or between multiple trustees.

- Modify distributions from the trust in response to changes in beneficiaries’ lives such as premature death, divorce, drug addiction, disability, or lawsuits.

- Allow new beneficiaries to be added when new descendants are born.

- Veto investment decisions that might be unwise

Warning for Your Trust Protector

The key to making a trust protector work for you is to be very specific about the powers available to that person. It is important to authorize that person, and any future trust protectors, to fulfill their duty to carry out the trustmaker’s intent—not their own.

Can You Benefit from a Trust Protector?

The answer is yes. Trust protectors provide flexibility and an extra layer of protection for the trustmaker’s intent as well as for the trust’s accounts and property and its beneficiaries. Trust protector provisions can easily be added to a new trust, and older trusts may be changed to add a trust protector. If you have created a trust or are a beneficiary of a trust that feels outdated, call our office now.

About Skvarna Law Firm in Glendora and Upland, California

Let a skilled attorney assist with your estate plan. So, contact us today to learn about your options (909) 608-7671. We operate offices in Glendora and Upland, California. Therefore, we provide legal services for individuals living in San Bernardino, Los Angeles, Orange, and Riverside Counties. This includes the cities of Upland, Ontario, Rancho Cucamonga, Fontana, Colton, Rialto, Chino, Chino Hills, Glendora, Claremont, Montclair, Pomona, La Verne, San Dimas, Azusa, Covina, West Covina, Diamond Bar, Walnut, La Puente, Corona, Norco & Mira Loma. Visit SkvarnaLaw.com to learn more.