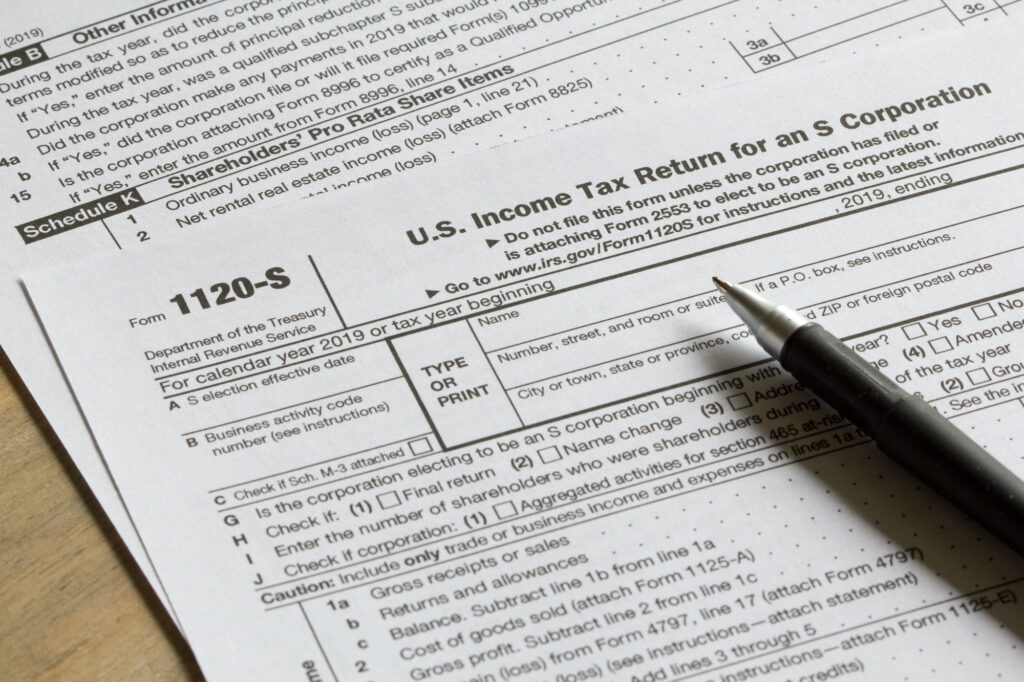

The Internal Revenue Service (IRS) describes S corporations as “corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes.”

-

Sign up for Newsletter

Sign up for Newsletter

Signup for our newsletter to get notified about sales and new products. Add any text here or remove it.

Error: Contact form not found.

-

Sign up for Newsletter

Sign up for Newsletter

Signup for our newsletter to get notified about sales and new products. Add any text here or remove it.

Error: Contact form not found.