Part 1 of a 2-Part Series

Low-interest rates led to record-breaking mortgage refinancing across the country. Millions of homeowners are scrambling to refinance their home loans before the end of the year. After all; even a few tenths of a percentage point of interest, paid monthly for 30 years, significantly reduces the amount of interest paid on a loan. Thus, for many, now is the time to refi. Other than the associated transaction fees, little to no downside applies to refinancing in this financial climate. However, one often overlooked consideration is the impact refinancing could have on your estate plan.

Refinancing Property in Your Name

Whether you own real estate solely or jointly, refinancing only slightly impacts interest in the property upon your death. If your name appears solely on the deed, your Last Will & Testament names the recipient of the property when you die. Of course, if a lender maintains a lien against the property to secure the loan, owners will have to pay off the loan before transferring it to the new owner. The executor must satisfy all debts of the deceased individual before transferring the property.

Intestacy Proceeding & Refinancing

Without a will, families must file an intestacy proceeding with the probate court. They must do so before transferring your property to heirs. “Intestacy” means dying without a will. In that case, state law names your property’s recipient. This is usually your spouse or children. But remember, if outstanding loans exist against your property, they must be paid off before disbursement.

Joint Property

If you jointly own your property with another person, (whether a spouse, child, multiple children, or friend), state law determines how to property distribution at your death. For example, owning a property with a spouse as joint tenants with rights of survivorship, your spouse would only need to file an affidavit (sworn statement). What’s more, to assume full ownership, they may need to file a death certificate with the county recorder where the property is located. However, if a bank holds a lien against the property, the bank will most likely insist that the loan be paid off before transfer. On the other hand, bank representatives could demand that the surviving joint owner requalifies for a loan. They may require this to ensure that the surviving joint owner can afford to make the payments.

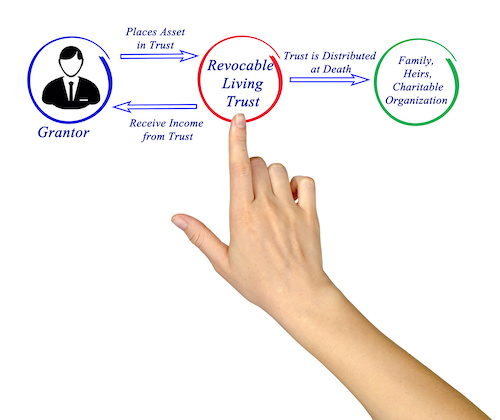

Property Owned & Refinanced in a Trust

Many individuals create a Revocable Living Trust (RLT). They do so to avoid probate and protect loved ones. An RLT maintains the accounts and property of the individual (Trust-maker). Accounts and property no longer owned by the trust-maker could be subject to probate. While the trust-maker may no longer own the accounts and property, then he or she retains the ability to manage and control the accounts and property. They serve as trustees of the trust. This gives them the ability to benefit from those accounts and property as the beneficiary of the trust.

Problems arise, however, when people refinance property titled in the name of a trust in low-interest-rate environments like these. Frequently, before a lender allows a trust-maker to borrow against the property in the trust, the lender requires the trust-maker to change the ownership of the property from the trust back to the trust-maker. Once the property is in the trust maker’s name, the lender makes the loan. And the trust-maker, as the owner of the property and borrower of the loan, signs all necessary paperwork to secure the loan. After the loan closes, the title company assisting with the title work prepares a deed to transfer the property from the trust-maker back into the trust.

Check back next week, when we conclude this two-part series about the ways refinancing impacts estate planning.

About Skvarna Law in Glendora and Upland, California

Skvarna Law Firm operates offices in Glendora and Upland, California. We provide legal services. We cover San Bernardino, Los Angeles, Orange, and Riverside Counties. This includes several cities. Upland, Ontario, Rancho Cucamonga, Fontana, Colton, Rialto, Chino, Chino Hills, Glendora, Claremont, Pomona, La Verne, Montclair, San Dimas, Azusa, Covina, West Covina, Diamond Bar, Walnut, La Puente, Corona, Norco & Mira Loma. Visit SkvarnaLaw.com to learn more.