Part 3 of a 3-Part Series

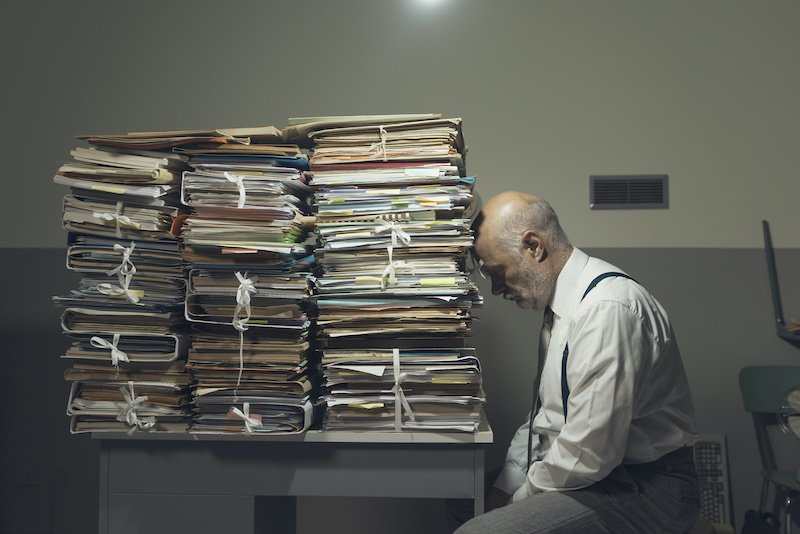

Over the past couple of weeks, we examined important things to consider after losing someone to death. To read part one, click here. To read part two, click here. This week, we conclude the series by focusing on paperwork.

Cancel benefits

Family member recipients of Social Security, veterans, or other benefits require government notification about the death. Never cash a benefit check which arrives after the recipient’s death. In fact, you must return benefits received after death. Timing of your family member’s death matters. A government agency may automatically reverse the last electronic distribution without warning.

Check subscriptions

Review subscriptions to newspapers, magazines, or other regular services. Check the mail to access all relevant paperwork.

Cancel credit cards.

Notify all of your loved one’s credit card companies of the death and close the accounts as soon as possible. It is also important to notify all three major credit bureaus of the death to avoid identity theft.

Locate insurance policies & paperwork

Find all your loved one’s insurance policies. Call the homeowner’s insurance company. Confirm that there is coverage for fire, flood, and/or other needed items as part of the homeowner’s insurance policy. In addition, locate your family member’s life insurance policies. Alumni associations, travel clubs, credit card companies, trade associations, etc. may have issued the policies.

Gather personal records

Locate all bank statements, checkbooks, canceled checks, and at least the past three years of income tax returns.

Determine if anyone owes money to your loved one

While gathering the needed personal records, check to see if there are any documents reflecting debts owed to the deceased individual. Contact those individuals to collect the amounts owed.

Keep These Legal Considerations in Mind

Once your loved one has passed away, anyone authorized by a power of attorney to act on his or her behalf is no longer valid. Therefore, if a family member was in charge of paying the deceased person’s bills as an agent under a financial power of attorney, that person should stop paying those bills after the individual has died. The executor of the will or trustee of the trust is now the proper person to handle those matters.

If your family member made arrangements for his or her funeral in advance utilizing a document such as a Remembrance and Services Memorandum, the deceased person’s written instructions may be legally binding under state law, and thus, the survivors may be obligated to comply with them. It is also possible that your family member pre-purchased their funeral arrangements through a local funeral home.

Property Paperwork

If any of your loved one’s property or money was not part of his or her trust at the time of death or was not made a part of the trust at the time of death automatically, that money or property must be handled through the probate process. That is, the money or property cannot be distributed to anyone, including the trust, without involvement by the probate court.

If there is any possibility that you or any other family member may want to disclaim any money or property you will inherit, it is important not to take any action that would be considered an acceptance of the inheritance. For example, if you are one of the beneficiaries of your loved one’s life insurance but decide that you would like for your share to go to the next beneficiary in line, do not complete any paperwork or accept checks involving the life insurance policy.

Distribution

Do not prematurely distribute any of your loved one’s property or funds. The executor of the will or trustee of a trust are the only individuals allowed to distribute your loved one’s money or property and must pay all debts and taxes before transferring any funds or property to the beneficiaries.

Call Us As Soon As Possible

Although you can take care of many of these initial concerns on your own, the administration of your loved one’s estate or trust can be quite complex. Even small mistakes could end up being a major headache. It is important to contact an experienced estate planning attorney to help you with probate or trust settlement and/or administration, as well as any other legal matters that may arise during this difficult and emotional time. Our goal is to provide you with peace of mind by guiding you through the administration and settlement of your family member’s trust or estate, so please call us as soon as you can.

About Skvarna Law Firm in Glendora and Upland, California

A skilled attorney can assist with your estate plan. Contact us today to learn about your options (909) 608-7671. We operate offices in Glendora and Upland, California. We provide legal services for individuals living in San Bernardino, Los Angeles, Orange and Riverside Counties. This includes the cities of Upland, Ontario, Rancho Cucamonga, Fontana, Colton, Rialto, Chino, Chino Hills, Glendora, Claremont, Montclair, Pomona, La Verne, San Dimas, Azusa, Covina, West Covina, Diamond Bar, Walnut, La Puente, Corona, Norco & Mira Loma. Visit SkvarnaLaw.com to learn more.