Part 2 of a 2-Part Series

Last week, we began a two-part series about Estate Planning for Unmarried Partners. To read part one of the series, click here. This week, we wrap up about the topic, which helps unmarried partners with estate planning.

Pay-on-Death or Transfer-on-Death Beneficiaries for Unmarried Partners

Naming your partner as the pay-on-death (POD) or transfer-on-death (TOD) beneficiary often leads to pitfalls. Some of these occur when you name them on beneficiary designation forms. Naming your partner as the pay-on-death (POD) or transfer-on-death (TOD) beneficiary often leads to pitfalls. Some of these occur when you name them on beneficiary designation forms. The POD or TOD option allows you to maintain control of the account during your lifetime.

Creditors’ Access

However, after you die, creditors may collect the money. What’s more, if your partner faced judgments, those may pass to you. Another downside of the POD or TOD option is that it grants your partner access to the money only upon your death. If you become incapacitated (unable to make your decisions), the accounts remain yours. Also, your partner would not access the funds – absent additional estate planning measures.

Name Unmarried Partners as Beneficiaries

A Last Will and Testament allows you to specify what your partner receives. This includes money and property owned solely in your name. It does not include that property which automatically passes to a surviving joint owner or beneficiary. Your partner will receive a lump sum or as installments over time. If you leave money or property to your partner, these items may prove vulnerable to the aforementioned risks. However, we can create a testamentary trust to provide extra protection for whatever you leave to your partner. However, if you use a will, your partner will face probate. In addition, a will becomes effective only at death. And it will not provide instructions or benefits in case you become incapacitated.

Name Your Partner as a Beneficiary of Your Revocable Living Trust (RLT)

A revocable living trust (RLT) is a trust you create during your lifetime. With an RLT, you can change it until you become incapacitated or die. While you remain alive and can make decisions for yourself, you serve as the current trustee (the person or entity who manages, invests, and hands out the money and property). You also serve as the current beneficiary. This allows you to continue enjoying the money and property during your lifetime. In the trust agreement, you name someone to manage the trust. You can also specify how to provide for your partner during any period of your incapacity.

Creditor Protection for Unmarried Partners

Also, you will decide which accounts or property to pass to your partner. What’s more, you determine how your property will be distributed to your partner at your death. Also, you will note anything you want your partner to receive. This helps to protect it from your partner’s creditors or judgments. This could prevent your partner from spending the money or selling the property to buy extravagant items. This may eliminate the need for probate. This offers a significant benefit which allows you to keep your affairs private.

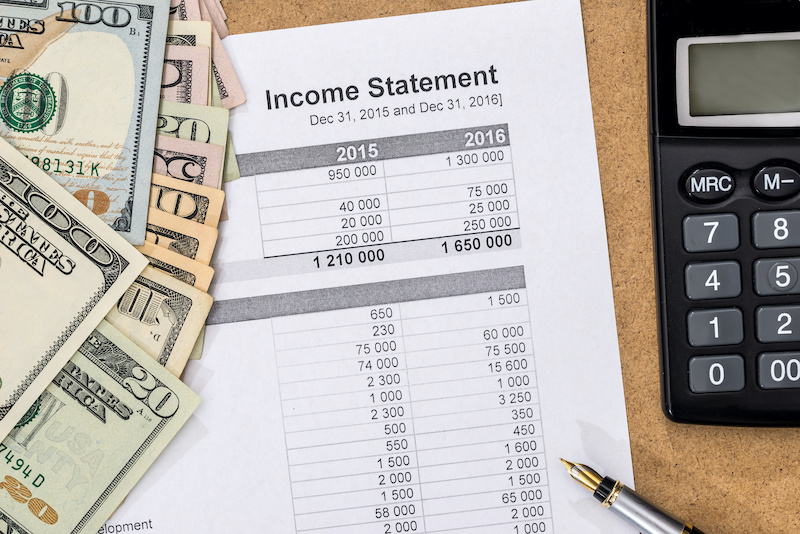

Taxable Income

After your death, your trust owns accounts that generate income that is not given to the beneficiaries. The trust will be taxed on the income, usually at a higher rate than what an individual would owe on the same income. Also, the longer the trust exists, the longer the management period. So, ongoing fees could be assessed for tax preparation, investment, and management fees, depending on who is the trustee.

We Are Here to Help

As you can see, you can choose between several different ways to provide for your partner during your incapacity or when you die. We are here to help you craft a plan that addresses your concerns and help you ensure that your partner is taken care of during all phases of life. Call us today to schedule your in-person or virtual consultation.

About Skvarna Law in Glendora and Upland, California

Skvarna Law Firm operates offices in Glendora and Upland, California. We provide legal services. We cover San Bernardino, Los Angeles, Orange, and Riverside Counties. This includes several cities. Upland, Ontario, Rancho Cucamonga, Fontana, Colton, Rialto, Chino, Chino Hills, Glendora, Claremont, Pomona, La Verne, Montclair, San Dimas, Azusa, Covina, West Covina, Diamond Bar, Walnut, La Puente, Corona, Norco & Mira Loma.