Part 2 in a 2-Part Series

Last week, we began a two-week series examining the estates of two celebrities who recently died. The first post focused on Chadwick Boseman. Click here to read that post. This week, we conclude our series by examining the estate plan of Eddie Van Halen.

Eddie Estate

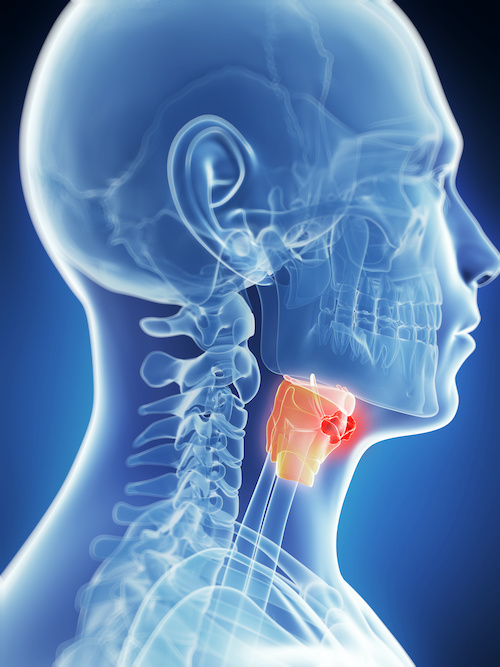

In October 2020, news that Eddie Van Halen died at the age of 65 after battling throat cancer. The news broke the hearts of fans around the world. Van Halen established himself as a rock-and-roll legend. He was the founder, primary songwriter, and lead guitarist for the rock band Van Halen. In 1974, he teamed up with his brother, Alex Van Halen, and two of their friends. The group emerged as one of the top rock bands of the 1970s and 1980s. Over the years, the band gained massive success, coupled with notable tensions. Through it all, Eddie Van Halen’s incredible guitar solos earned him a measure of respect not given to many in the field.

Eddie Van Halen in Person

Van Halen’s vices included significant drinking and chain-smoking. He also faced numerous ups and downs in his romantic life. In 1981, he married Valerie Bertinelli. And in 1990, the couple had a son, Wolfgang. Their marriage did not last. They separated in 2002 and divorced in 2006. Eddie married again in 2012. His second wife, Janie Liszewski, was his public relations representative.

State of the Estate

Doctors first diagnosed Eddie Van Halen with cancer in 2000. One effort to treat the cancer was surgery to remove one-third of his tongue. As a result, he was reportedly cancer-free for several succeeding years. However, cancer eventually returned and spread to his throat and esophagus. At the time of his passing, experts estimate Van Halen’s net worth at nearly $100 million. So far, little to no information has emerged regarding his estate. However, people suspect he had an estate plan in place.

Van Halen’s Estate Lessons

Even people with far less stardom than Van Halen superstardom experience things in life like divorce, children, and remarriage. In all such cases, estate planning issues should be considered:

- Estate planning should account for any alimony (spousal support) in place at the time of a divorce.

- The terms of the divorce and the conclusions regarding property ownership may significantly impact the distribution of money and property.

- Other considerations relative to children should be addressed.

- This becomes even more important when children enter the picture via a second marriage.

- Even though Van Halen’s family situation does not require analysis, another factor that likely impacted his planning was that his only son, Wolfgang Van Halen, worked with his father.

- Because of the significant assets involved in this estate, we hope Van Halen utilized trust instruments to facilitate the easy transfer of property and assets to his intended recipients.

Estate Planning for You

Everyone eventually dies. To help you make things easier for your loved ones, please call our office to schedule a consultation with one of our experienced attorneys. Estate planning is necessary whether you are interested in protecting your privacy or ensuring your child or spouse’s care, and we are here to help.

About Skvarna Law in Glendora and Upland, California

Skvarna Law Firm operates offices in Glendora and Upland, California. We provide legal services. We cover San Bernardino, Los Angeles, Orange, and Riverside Counties. This includes several cities. Upland, Ontario, Rancho Cucamonga, Fontana, Colton, Rialto, Chino, Chino Hills, Glendora, Claremont, Pomona, La Verne, Montclair, San Dimas, Azusa, Covina, West Covina, Diamond Bar, Walnut, La Puente, Corona, Norco & Mira Loma. Visit SkvarnaLaw.com to learn more.