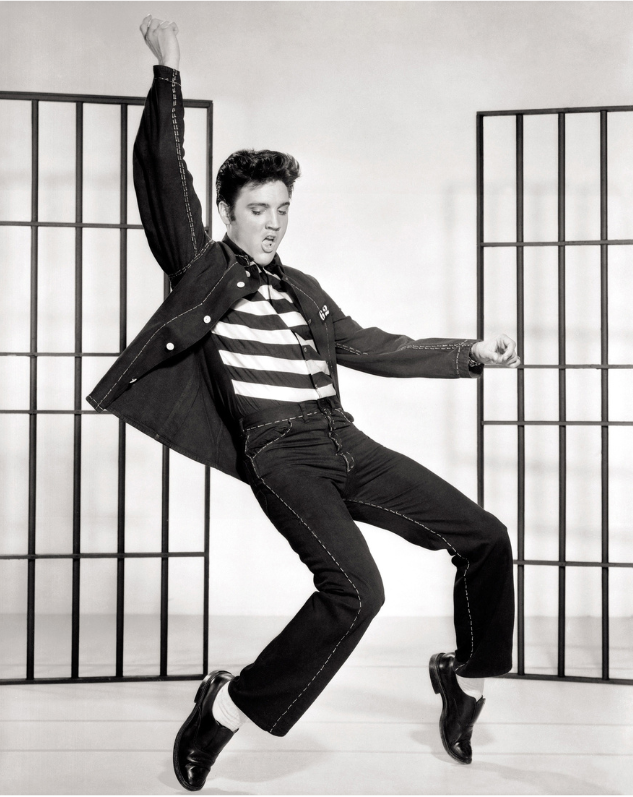

Elvis Presley, the King of Rock and Roll, died in 1977. Like most A-list celebrities, he left behind a complicated legacy—and a considerable estate. Elvis’s estate, including Graceland, passed to his only child, Lisa Marie Presley. She died in January at 54 years old. Therefore, now, it is set to pass to Lisa Marie’s three daughters. In this blog post, we examine the celebrity trust of the Presley dynasty.

Unfortunately, several issues complicate Lisa Marie’s estate. Personal financial issues, a wide age gap between her children, and a challenge by Mother Priscilla Presley cast doubt over what will happen not only to her estate, but the future of Elvis’s legacy.

Lisa Marie: Her Inheritance and Finances

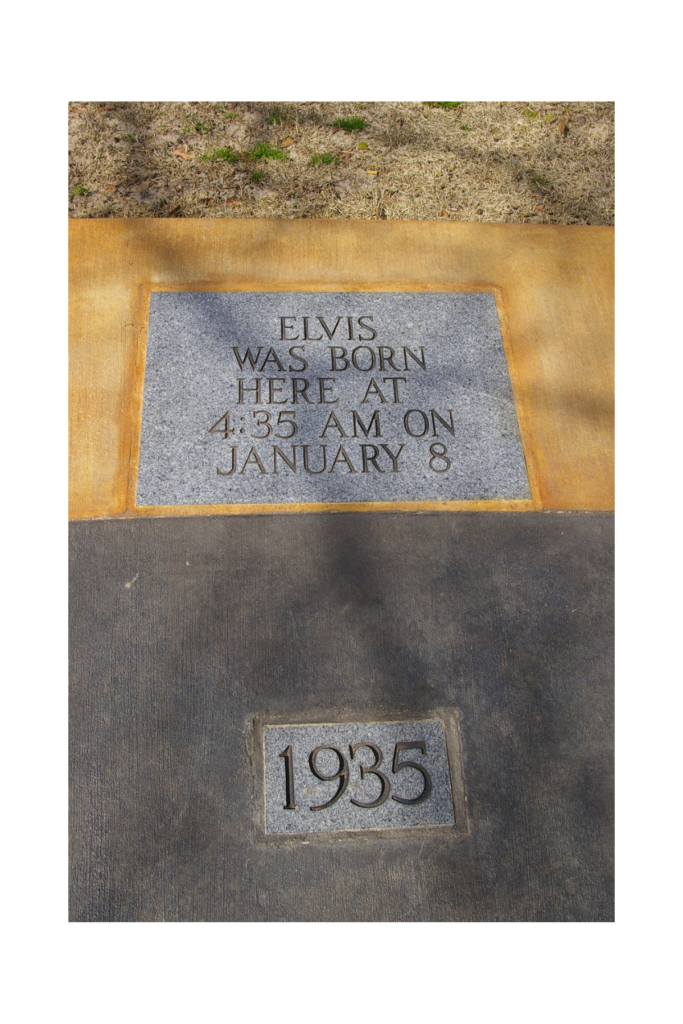

Born in 1968 to Elvis and Priscilla Presley, Lisa Marie followed in the footsteps of her father as far as heart trouble. While her father died from a heart attack at the age of 42, she died due to heart problems nearly 46 years later, in January 2023.

Elvis remained popular even in the decades after his death. For example, his estate raked in an estimated $400 million last year. Furthermore, the 2022 Elvis biopic movie boosted the value of the estate from around $500 million to more than $1 billion.

The Elvis Presley Trust

After Elvis died, the court put his estate in a trust. They assigned the beneficiary duties to Lisa Marie, Elvis’s grandmother, and his father. Elvis stipulated that the court hold Lisa Marie’s inheritance in trust for her until her 25th birthday on February 1, 1993. On that date, the trust automatically dissolved, and Lisa Marie inherited $100 million.

Part of her inheritance was her childhood home, Graceland, which has become a museum and international tourist attraction that generates over $10 million per year. Lisa Marie started a new trust, the Elvis Presley Trust, to continue managing Graceland and the rest of the Elvis estate, which also includes the business entity Elvis Presley Enterprises, Inc (EPE). Lisa Marie was owner and chairperson of the board of EPE until 2005, when she sold 85 percent of its assets.

Priscilla Presley’s Celebrity Trust Challenge

Priscilla Presley has disputed the validity of a 2016 amendment to Lisa Marie’s trust that removed Priscilla and a former business manager as trustees and replaced them with Riley Keough and Benjamin Keough. Court filings indicate that Priscilla says she was not notified of the change as required by law. She also claims no one witnessed or notarized the amendment. What’s more, someone misspelled her name in the document. She also thinks her daughter’s signature looked unusual. Priscilla asked a judge to invalidate the amendment that removed her as trustee.

Lisa Marie’s Financial Troubles

By 2016, Lisa Marie’s $100 million trust had shrunk to just $14,000 cash. This revelation came from a lawsuit against her manager, Barry Siegel, for allegedly mismanaging her wealth. Lisa Marie claimed in 2016 divorce documents that she was $16.67 million in debt. In 2019, Siegel, who counter-sued Lisa Marie, said the deal to sell off her 85 percent stake in EPE cleared up over $20 million in debts she had incurred.

Celebrity Trust Creditor Claims

While her financial status is still unclear, if Lisa Marie was in debt, her creditors would have the chance to make claims against her estate. The estate has the option to honor or reject any creditor claims. Rejection could lead to litigation. Because creditors receive priority over those entitled to inherit Lisa Marie’s money and property, her accounts and property, including Graceland, might have to be liquidated or sold to satisfy Lisa Marie’s debts. In her case, estate taxes could also be due even after debt is calculated, and an estate tax valuation could take time if creditors bring lawsuits against Lisa Marie’s estate.

Control What You Can with an Estate Plan in a Celebrity Trust

Lisa Marie Presley’s tragic and untimely passing is a reminder that none of us know the time, place, and manner of our death. But we can assert control over our legacy through estate planning.

About Skvarna Law Firm in Glendora and Upland, California

Let a skilled attorney assist with your estate plan. So, contact us today to learn about your options (909) 608-7671. We operate offices in Glendora and Upland, California. Therefore, we provide legal services for individuals living in San Bernardino, Los Angeles, Orange, and Riverside Counties. This includes the cities of Upland, Ontario, Rancho Cucamonga, Fontana, Colton, Rialto, Chino, Chino Hills, Glendora, Claremont, Montclair, Pomona, La Verne, San Dimas, Azusa, Covina, West Covina, Diamond Bar, Walnut, La Puente, Corona, Norco & Mira Loma. Visit SkvarnaLaw.com to learn more.