How you title your real estate carries significant legal consequences. Ownership structure determines who controls the property, how vulnerable it remains to creditors, and how the property transfers after death. Many people assume their estate plan alone controls what happens to their home or investment property. In reality, the title on the deed often dictates […]

Category Archives: Trustee

5 Things Every New Parent Needs to Know About Wills as the New Year Begins The New Year often marks a season of reflection, intention, and planning. For new parents, that sense of responsibility deepens quickly. A new baby changes priorities overnight. Decisions that once felt optional now feel essential, especially when thinking about your […]

When a Trustee Becomes a Burden: Knowing When to Fire a Trustee In recent posts, we’ve discussed the importance of creating a comprehensive estate plan that safeguards your legacy and protects your family. A key part of that plan often involves choosing a trustee. The title “trustee” implies trustworthiness, and for good reason. This role […]

5 Reasons a Family Member May Not Be the Best Trustee Choice Establishing a trust is one of the most important decisions you can make to protect your assets and provide long-term security for the people you care about. But no matter how carefully the trust is drafted, its success largely depends on one critical […]

Are you looking to secure your family’s future and protect your hard-earned assets? Skvarna Law Firm stands as your trusted partner in estate planning, offering expert asset protection. With offices strategically located in Glendora and Upland, we bring a wealth of experience and local knowledge to help you navigate the complexities of estate planning in […]

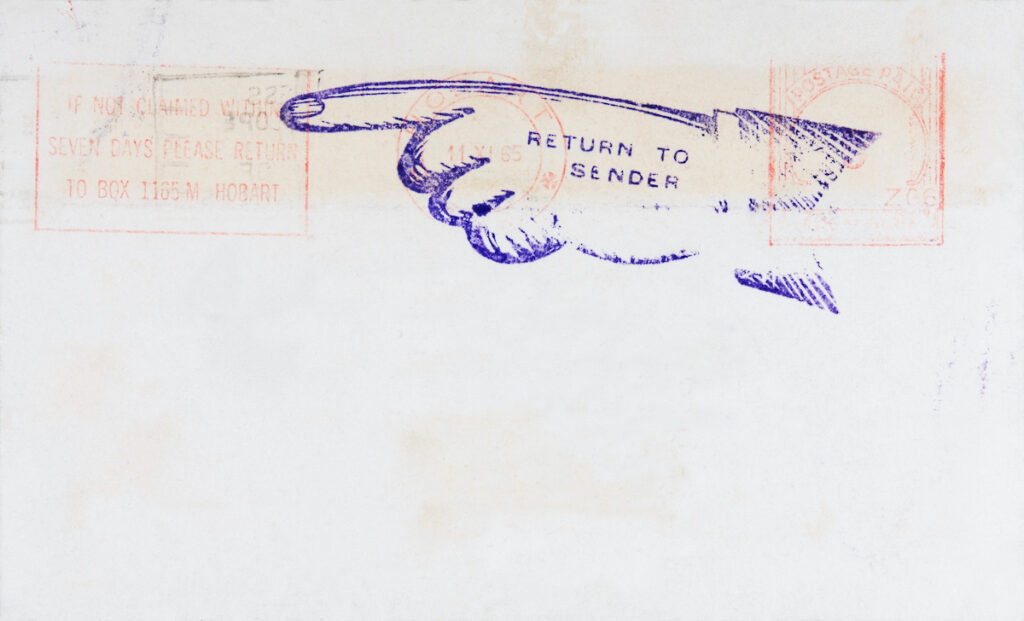

Losing someone you love to death is difficult. When your loved one’s mail continues to arrive, you may struggle even more. Once the court appoints you executor or personal representative of a deceased loved one’s probate estate, take these steps. The same is true if you serve as the successor trustee of the loved one’s […]

Admittedly, no one makes a suitable substitute for you as a parent. Nevertheless, a guardian steps in when you pass away to assume your parental role and raise your minor child through legal adulthood. Conversely, a trustee manages the financial legacy you leave behind for your minor child. As a parent, you need to consider the skills and characteristics each role requires to ensure that you nominate the right people for the benefit of your child and their inheritance.

Before setting up an RLT, you should understand what you can—and cannot—do in your dual role as trustmaker and trustee. Living trusts are complex legal documents that need to be drafted carefully with help from an estate planning attorney.

A living trust is a legal document that allows you to transfer your assets into a trust during your lifetime. This can help your estate avoid probate, a potentially lengthy and expensive legal process. A living trust also provides privacy, as it does not go through the probate process, which is a matter of public record.

Depending on who your beneficiary is, some options might be a better fit than others. It is important that you understand who your beneficiary is, what their needs are, and what your desired outcome is.