In January 2024, Jay Leno petitioned the court as the conservator of the estate of his wife, Mavis Leno. His reason for this is so he prepare an estate plan on her behalf and for her benefit. Unfortunately, doctors diagnosed Mrs. Leno with dementia and has impaired memory. Her impairment has made it impossible for her to create her own estate plan or participate in the couple’s joint planning. According to court documents, Mr. Leno wanted to set up a living trust and other estate planning documents to ensure that his wife would have “managed assets sufficient to provide for her care” if he were to die before her. Right now, Mr. Leno is managing the couple’s finances, but he wanted to prepare for a time when he is no longer able to do so.

Category Archives: Estate Planning

Create your first estate plan in a way that won’t lock you into the plan for the rest of your life. The following are common changes we can make to your estate plan to ensure that we adequately address your evolving concerns and wishes.

Update your estate plan every 3 to 5 years. What’s more, if you have an adult child who still lives at home or recently had an adult child move back in with you, review the plan and make any necessary changes. Doing so is the only way to ensure that the court adequately addresses your wishes.

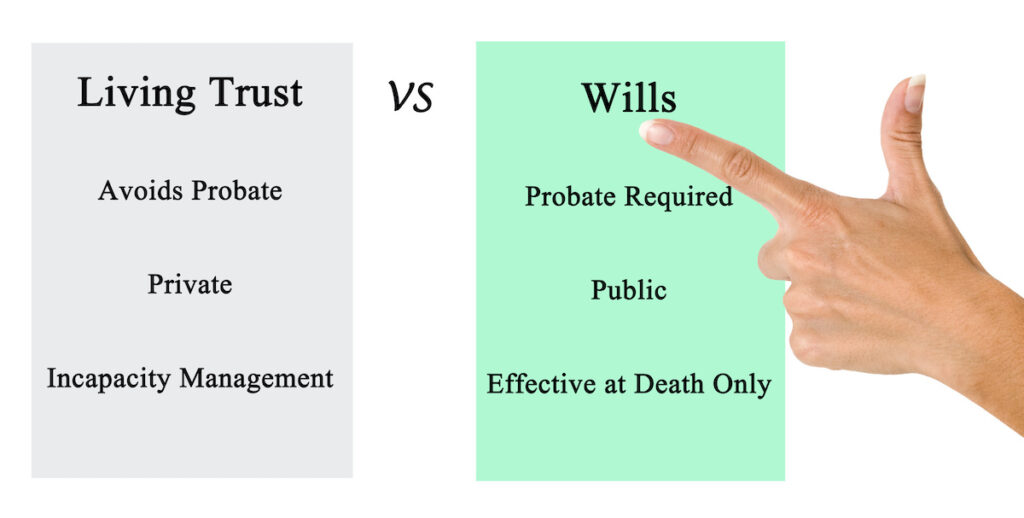

Before setting up an RLT, you should understand what you can—and cannot—do in your dual role as trustmaker and trustee. Living trusts are complex legal documents that need to be drafted carefully with help from an estate planning attorney.

The Centers for Disease Control and Prevention (CDC), reports one in four US adults have some type of disability. Frustratingly, disability may render you unable to manage your own affairs. This is also known as being incapacitated. In this case, you will not be able to turn back the clock. So, make plans that will make your transition into a possible incapacity as smooth as possible. You can take meaningful actions prior to an incapacity. This protects your money, property, and legacy in the wake of any newfound limitations:

How you give or loan money to family members has potential tax implications. The right method depends on your family circumstances.

The legally valid written instructions that a person creates describing how they want their money and property distributed upon their death. Wills are highly recommended, but there is no legal requirement to have one. To make a will legally valid, it must be properly executed in accordance with state law. Executing a will involves signing the document in front of witnesses. Additionally, at the time of signing, the creator must have capacity (i.e., be of sound mind).

An important part of being a responsible business owner includes developing systems to help other people operate the company without you. A business succession plan clearly states who will take over specific roles, hopefully reducing any potential disputes between family members or key employees. If the business is sold after a transition event occurs, a comprehensive business succession plan will also clearly outline the sale price and purchase terms.

Pension and retirement accounts form a large portion of an individual’s wealth. Thus, make sure you account for them in your estate plan. If a retirement account holder completes a proper beneficiary designation, their account assets will bypass probate. Account holders often designate a surviving spouse or children as beneficiary, but they could also name a trust or a charity.

Communication with attorneys is protected by attorney-client privilege, which ensures confidentiality. Most nonlawyers cannot offer the same level of privacy, potentially jeopardizing sensitive information and creating legal risks.