When a Trustee Becomes a Burden: Knowing When to Fire a Trustee In recent posts, we’ve discussed the importance of creating a comprehensive estate plan that safeguards your legacy and protects your family. A key part of that plan often involves choosing a trustee. The title “trustee” implies trustworthiness, and for good reason. This role […]

Category Archives: Estate Planning

You Cannot Afford to Make These Estate Planning Blunders Many people think a simple will covers all their future goals. In reality, a flawed estate plan can create just as many headaches, heartaches, and expenses as having no plan at all. Life changes, laws evolve, and even good intentions can fall short. Without proper updates, […]

Which one do you need? A Will or Trust? Every adult needs a will, a trust, or both. These essential estate planning control your legacy. Further, they make sure your loved ones are cared for. And, finally, they provide peace of mind that your wishes won’t be left to chance. A properly drafted trust can […]

3 Simple Ways to Avoid Probate Costs Probate is a word that makes many families nervous—and for good reason. When someone dies owning property in their sole name without a beneficiary, their loved ones must go through a court-supervised process to transfer that property. Known as probate, this process often brings delays, stress, and significant […]

What to Do When You Do Not Own What You Think You Own In recent posts, we’ve discussed the importance of having a clear estate plan to protect your assets and your family. One of the most frustrating and costly situations arises when someone believes they own property—only to learn later that they do not […]

Golf and estate planning share one important truth: preparation and strategy determine success. While golf requires adjusting to changing conditions on the course, estate planning requires adjusting to life’s changes—marriage, children, retirement, or shifts in financial circumstances. Both benefit from having the right tools, a clear plan, and periodic review. In this post, we discuss […]

Trusts are powerful estate planning tools, especially when created to protect a child’s financial future. However, if you establish your child’s trust when they are five, that may not serve the same purpose—or offer the same protection—when they’re 25 or 45. Just as your child grows and changes over time, so too must the legal […]

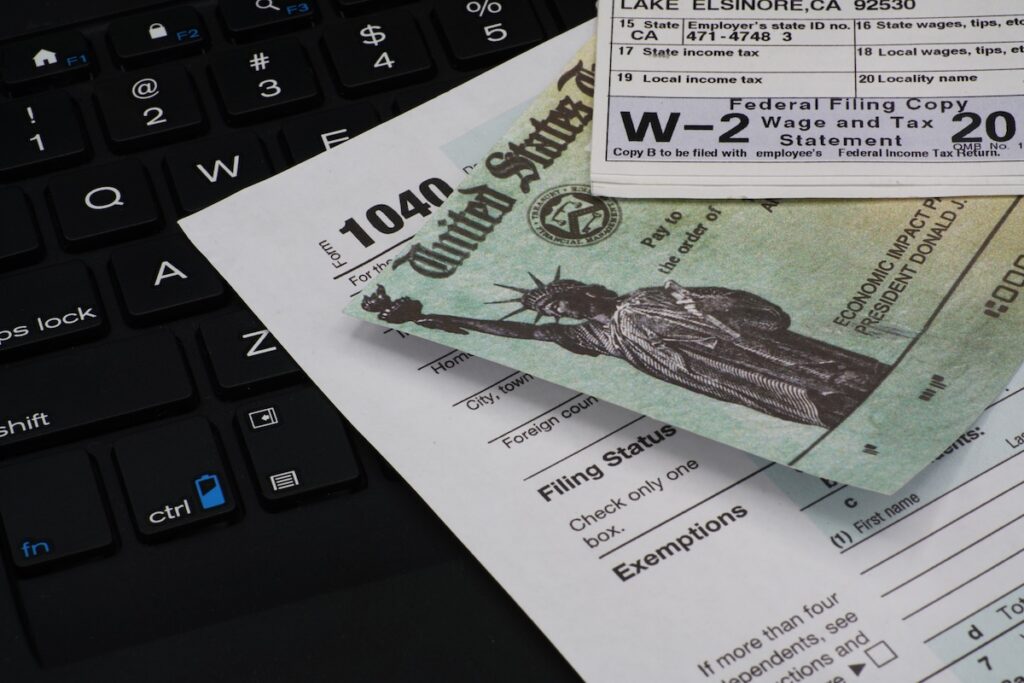

Is an Income Tax Time Bomb Lurking in Your Estate Plan? The federal estate tax exemption has grown significantly—from $5 million in 2011 to nearly $14 million in 2025. As a result, far fewer families face federal estate tax issues today. But there’s another kind of tax concern that’s increasingly relevant: income tax basis planning. If […]

Deployment on the Horizon? What You Need to Do to Get Your Affairs in Order In recent posts, we’ve discussed how estate planning can support families during life transitions such as marriage, parenthood, or divorce. This week, we focus on military personnel. Specifically, we cover which legal and planning steps to take before a deployment, […]

Estate Planning Strategies to Protect Your Spouse In recent posts, we’ve discussed topics such as divorce and estate planning as well as disinheriting a spouse. This week, let’s focus on what you can do to protect your spouse in estate planning. Marriage legally positions you to provide long-term financial security for your spouse through legal […]