Founded in 1998, PayPal was not the first company to offer online payments, but it was the first to obtain widespread adoption and is the top payment application among Americans today, with around three out of four respondents saying they are active users.

Category Archives: Assets

This person is a trusted decision maker who is tasked with handling all matters that relate to your trust. Depending on the type of trust, you could be the trustee in the beginning and need someone else to act as trustee only when you are unable to manage the trust, or you could select a trustee to act immediately.

If you are in a long-term relationship with your partner but remain unmarried, you may want to take advantage of these benefits. However, joint trusts do not work for unmarried couples. This may not seem fair. However, there are some important reasons why unmarried couples should consider separate rather than joint trusts.

Seek out resources if you lost your job through no fault of your own. Some employers offer severance packages. And in many cases, you could collect unemployment benefits. Depending on state law and your former employer’s policy, a payout of accrued vacation and sick leave may fund source of liquidity to sustain you for a while.

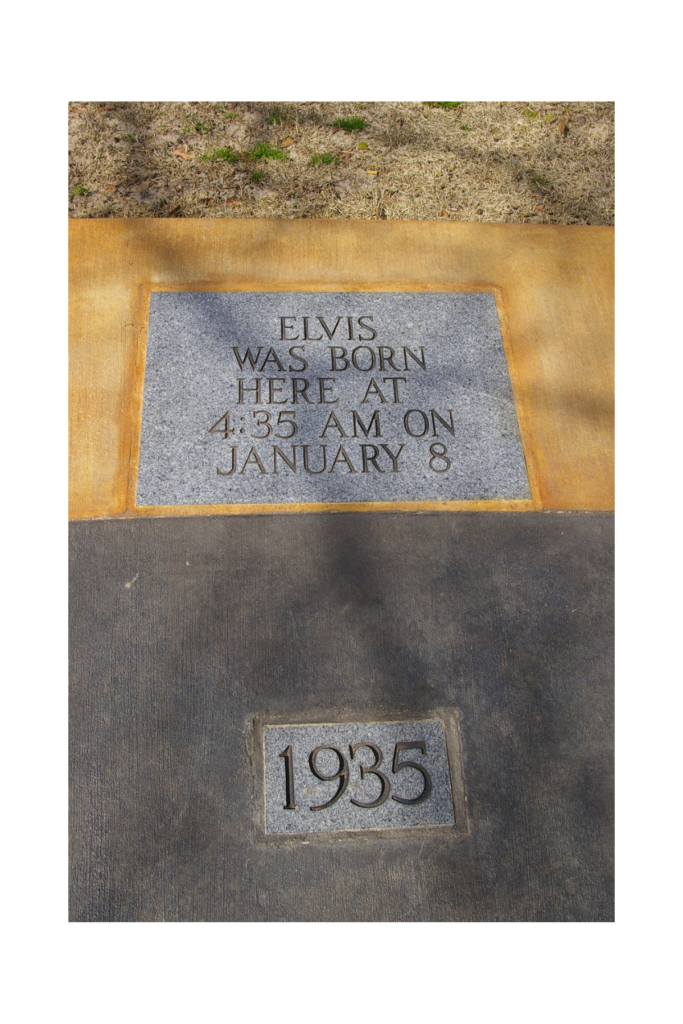

Born in 1968 to Elvis and Priscilla Presley, Lisa Marie followed in the footsteps of her father as far as heart trouble. While her father died from a heart attack at the age of 42, she died due to heart problems nearly 46 years later, in January 2023.

Between planning, permitting, and construction, the home remodeling process can take months to complete. But even after the finishing touches have been applied, you may still have work to do. If the home is part of an estate plan, a remodel can affect that plan and require changes to it. To keep your estate plan up to date, make sure to discuss a home remodeling project with an attorney.

Raquel Welch had a reported net worth of $40 million. This will presumably go to her two adult children. However, few details reveal Welch’s estate plan. This suggests that she was also savvy about estate planning.

Complex probate processes can be costly and take years to finalize, which is why many individuals retain an estate planning attorney to minimize probate proceedings.

Elder law lawyers may also focus on representing individuals with special needs and their families throughout the process, including attending hearings and communicating with the court. Navigating the legal process can be complex and vary by state. An elder law, disability, or special needs attorney will take all necessary steps and meet all deadlines throughout the legal process.

Aaron Carter failed to achieve the stardom of his older brother Nick. Nevertheless, he succeeded as a performer in his own right. He opened for the Backstreet Boys at age nine.