While many assume that a will or trust signed in an attorney’s office is valid, such is not always the case. Attorneys who do not specialize in estate planning may be unfamiliar with the formalities required to make a will or trust legally valid in their state.

Author Archives: Skvarna Law

Imagine spending thousands of dollars on an estate plan to protect loved ones, to find that no true protection exists. Unfortunately, this occurs on a regular basis. In fact, millions fall prey to estate planning scams each year. According to a report conducted by the U.S. Consumer Financial Protection Bureau of people ages 50 and over, victims […]

Most people agree that a long life is good. However, life alone does not guarantee ideal circumstances. For example, longevity, coupled with physical or mental incapacity, can prove challenging.

Keep a majority of the details private until your death, Start the conversation with successor trustees.

Healthcare documents (such as a Medical POA, Advanced Directive or Living Will, and Health Insurance Portability and Accountability Act (HIPAA) authorization form) primarily focus on medical matters. However, they may also impact the financial matters handled by the successor trustee.

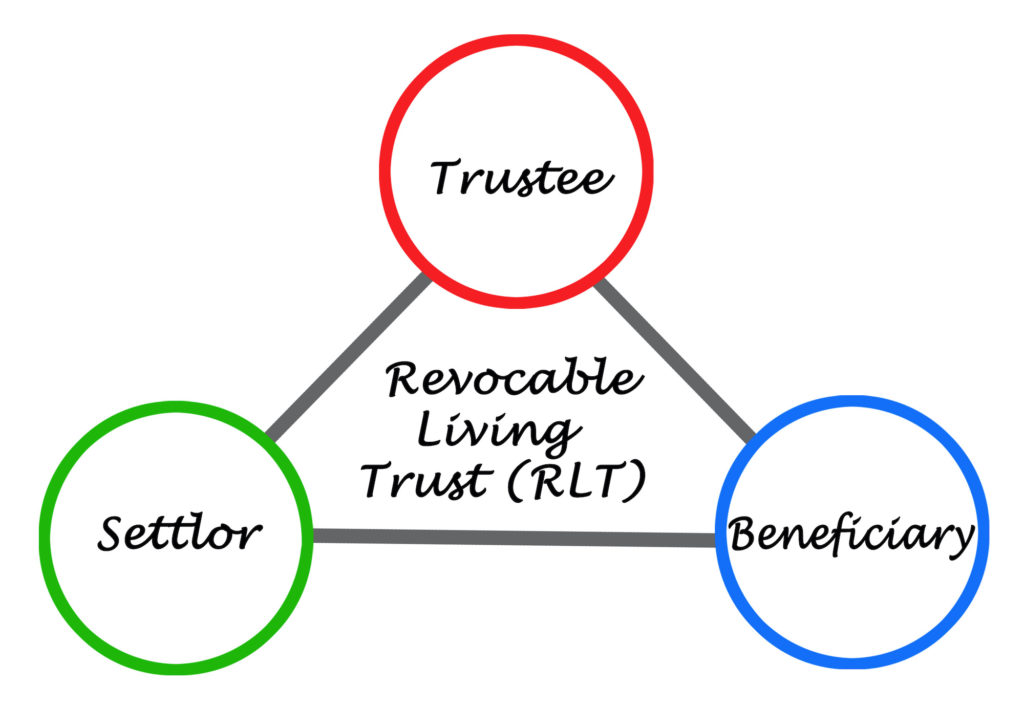

Unlike other estate planning options, an RLT grants the ability to maintain control and enjoy accounts and property during someone’s lifetime. What’s more, it maintains privacy relative to how to manage accounts and property.

Name someone to serve with you. This familiarizes your co-trustee with your trust. It also teaches your partner about the way you want the trust to operate. What’s more, it lets you evaluate your co-trustee’s abilities.

Busy as ever, many of us supervise kids (in-person or virtually), pursue new employment opportunities and/or adapting to new work environments. What’s more, most of us are adjusting savings and investment goals.

If you plan to refinance a property, call today so we can make sure that your lender, the title company, and you remain on the same page. What’s more, we want to ensure the property you refinance is titled correctly.

Part 1 of a 2-Part Series Low-interest rates led to record-breaking mortgage refinancing across the country. Millions of homeowners are scrambling to refinance their home loans before the end of the year. After all; even a few tenths of a percentage point of interest, paid monthly for 30 years, significantly reduces the amount of interest […]