Part 2 of a 3-Part Series

Last week we began a three-part series, focusing on estate planning for the death of a minor child. Click here to read part one. Admittedly, one of the greatest shocks that life can deliver, no one could ever prepare for the cascade of challenges that accompany such an event. Nevertheless, help is available. Thankfully, the resources available may help ease the burdens that you and your loved ones would face during this terrible time.

Crowdfunding When a Child Dies

A great way to assist with medical, funeral, or burial expenses when a child dies is to use crowdfunding resources. Consider online forums such as GoFundMe or Funeralfund. These platforms allow organizers to reach out through the web to solicit donations. Users spend these funds on funeral and related expenses, such as grief counseling. These platforms charge minimal processing fees. People who donate to the fund can do so anonymously if they wish. The ability to quickly get the word out to friends, family, coworkers and even strangers is helpful for people grieving over the death of a child. This type of fund could help your family in your time of need, to ease the financial burden of the loss of a child.

If you do not feel comfortable organizing a crowdfunding campaign, ask an internet-savvy friend or family member for help. You may be surprised about how eager others will be to help. Remember that accepting such help enables others to mourn with you and do something when they otherwise feel powerless. So, don’t be afraid to ask.

Property: When a Child Dies

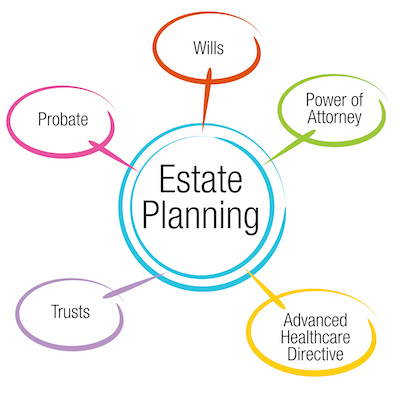

In some cases, you may be able to use the money which belonged to minor children to pay for funeral expenses. Parents or grandparents often give funds to minors. They set up accounts provided for by state law. Referred to as Uniform Gifts to Minors Act (UGMA) or Uniform Transfer to Minors Act (UTMA) accounts, heirs can use these accounts to offset late illness and funeral expenses. A court-appointed guardian or conservator typically manages such money or property. A deceased child with a UGMA or UTMA account can use the funds to pay for a child’s estate. This applies unless the court assigns a beneficiary designation.

With significant funds in the account, the family may need to file probate to claim the funds. However, most states follow a small estate affidavit process. In it, a full-blown probate court action can rule about whether the money in the account is less than a certain amount (for example, less than $100,000 in some states).

Social Media and Digital Assets After a Child Dies

Today, many youths, particularly teens, maintain an extensive social media presence. Some popular platforms include Snapchat, TikTok, YouTube, Instagram, and Facebook. You may need to close some of these social media accounts. In other cases, you may convert them to memorial accounts. These accounts clarify that the user died. The process freezes the account so that no one can fraudulently post on behalf of the person who passed. Consider shutting down any social media accounts or memorializing them so that online friends will know the user died.

Some social media accounts generate income (if the minor monetizes the account). Blogs, websites, and YouTube channels sometimes generate considerable ad revenue. If your child hosted an account like these, take the steps necessary to claim those accounts, and use the revenue appropriately. An estate attorney helps ensure that the social media companies deal fairly with you according to applicable digital asset laws.

Check back next week, when we conclude this three-part series.

About Skvarna Law in Glendora and Upland, California

Skvarna Law Firm operates offices in Glendora and Upland, California. We provide legal services. We cover San Bernardino, Los Angeles, Orange, and Riverside Counties. This includes several cities. Upland, Ontario, Rancho Cucamonga, Fontana, Colton, Rialto, Chino, Chino Hills, Glendora, Claremont, Pomona, La Verne, Montclair, San Dimas, Azusa, Covina, West Covina, Diamond Bar, Walnut, La Puente, Corona, Norco & Mira Loma. Visit SkvarnaLaw.com to learn more.