To establish a trust, you name someone the trustee. A trustee manages your financial affairs in your absence. These include:

- Collecting income

- Paying bills and taxes

- Saving and investing for the future

- Buying and selling property

- Providing for your loved ones

- Keeping accurate records

- Generally working to keep things organized and in good order

Key Trustee Takeaways

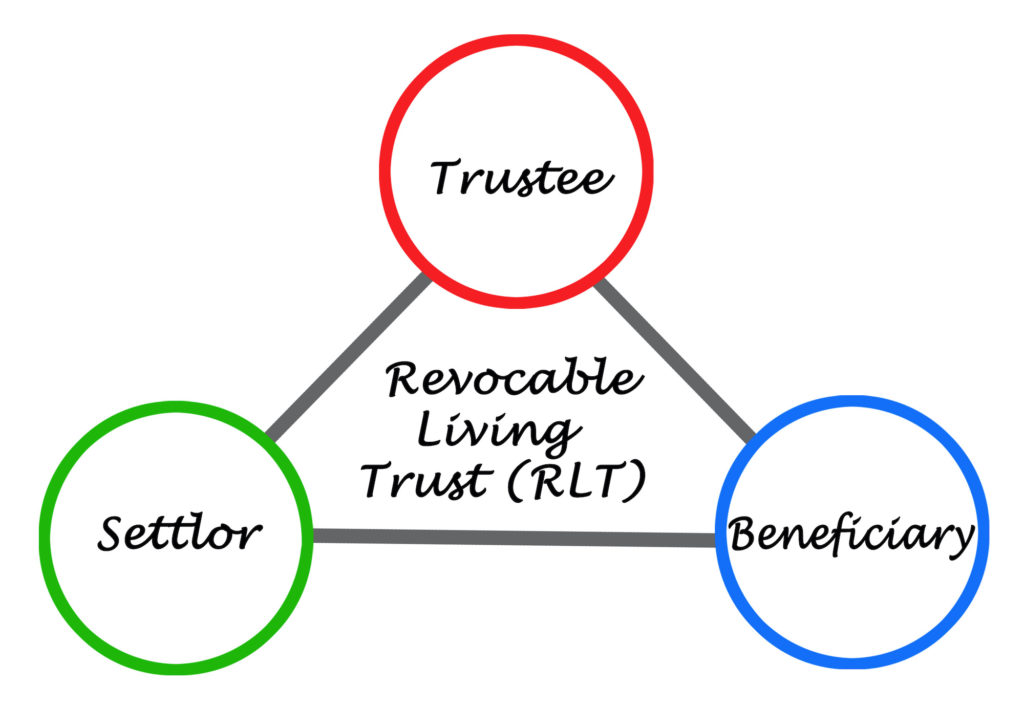

- You can serve as the trustee of your Revocable Living Trust (RLT). Your spouse could serve as co-trustee.

- Most irrevocable trusts do not allow you to serve as trustee.

- Even though you might be able to serve yourself, that might not be the best choice.

- You could choose an adult child, a trusted friend, or a professional or corporate entity.

- Name someone to serve with you. This familiarizes your co-trustee with your trust. It also teaches your partner about the way you want the trust to operate. What’s more, it lets you evaluate your co-trustee’s abilities.

Trustee Qualifications

If you or your spouse become incapacitated or die, the other can handle your financial affairs without interruption. Most married couples who own joint accounts and property, serve together.

However, you may choose not to be your own trustee. Some people select an adult son or daughter, a trusted friend, or another relative. Others prefer to name a professional (e.g., a bank trust department or trust company). They go this route for the associated experience and investment skills. Naming someone else does not mean you relinquish control. The trustee must follow the instructions in the trust and report to you. You can even replace the trustee if you change your mind.

When to Consider a Professional or Corporate Trustee

A professional or corporate trustee sometimes proves invaluable. For example, you may be elderly, widowed, or in declining health. You may not have had children or interacted with other close relatives. Or other candidates may lack the ability or desire to manage your trust. In fact, you may simply not have the time, desire, or experience to manage investments by yourself. Also, tax laws and restrictions relative to irrevocable trusts may prevent you from serving. In such situations, a professional or corporate entity may fill the bill. After all, they have the experience, time, and resources to manage your trust. They can also help you meet your investment goals.

What You Need to Know

Professional or corporate trustees charge a reasonable fee to manage a trust. The charge may be worthwhile, when you consider everything they bring to the table.

Action Items

- Honestly evaluate whether you are the best choice to serve as trustee. Someone else may perform better than you, especially with regard to investing your money.

- Name someone now. This eliminates the time a successor would need to get up to speed about your trust, accounts and property, and your beneficiaries’ needs and personalities. This also allows you to see them in action. Thus, you can evaluate whether the person is the right choice to manage the trust in your absence.

- Carefully evaluate your trustee candidates.

- If you are considering a professional or corporate trustee, talk to several. Compare their services, investment returns, and fees.

We can help you select, educate, and advise your successor trustees. We will make sure they know what to do to carry out your wishes. Give us a call today.

About Skvarna Law in Glendora and Upland, California

Skvarna Law Firm operates offices in Glendora and Upland, California. We provide legal services. We cover San Bernardino, Los Angeles, Orange, and Riverside Counties. This includes several cities. Upland, Ontario, Rancho Cucamonga, Fontana, Colton, Rialto, Chino, Chino Hills, Glendora, Claremont, Pomona, La Verne, Montclair, San Dimas, Azusa, Covina, West Covina, Diamond Bar, Walnut, La Puente, Corona, Norco & Mira Loma. Visit SkvarnaLaw.com to learn more.