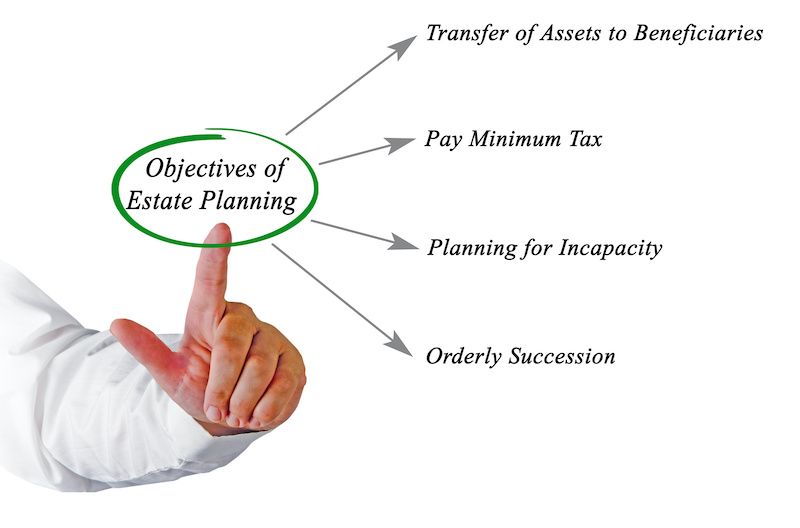

Estate planning prepares people for the inevitable. Thus, a good estate plan allows for the unexpected. Your estate plan may detail instructions for what happens when you die. However, what if something happens while you remain alive? This blog post explains uses for a Springing Financial POA.

Financial POA vs Springing

If something renders you unable to manage your affairs, someone else steps in to act on your behalf. A Financial Power of Attorney (POA) is a legal document. It allows the writer to designate a trusted person to make financial decisions. These include signing checks, opening bank accounts, collecting mail, etc.) Sometimes, the Financial POA is immediate. This authorizes someone to act for you now and into the future. Alternatively, a Springing POA goes into effect only when something unusual occurs. One example is incapacitation.

Springing Specifics

While every estate plan should feature a Financial POA, a Springing Financial POA requires more nuance relative to limitations. Additionally, even when someone writes the Springing POA carefully, problems often emerge. That said, some people prefer a financial POA kicks in only when necessary.

How a Springing Financial POA Works

Conditional, this type of POA springs into action only at the time of incapacitation. This differs from an Immediate Financial POA. These are not conditional. An immediate Financial POA functions like an active permission slip. Once signed, it grants someone broad legal authority to take over responsibilities. By contrast, after signing a Springing Financial Power of Attorney, it remains inactive until necessary.

Defining Incapacity

When does someone need this tool? Generally, this tool remains unnecessary unless you become incapacitated. Incapacity applies to several things. For example, mental illness, mental deficiency, physical illness or disability, advanced age, drug abuse, or unusual events (such as kidnapping or disappearing) apply.

What Happens When Springing Financial POA Takes Effect

After a Financial POA springs, the person nominated to handle your affairs may do what you would have otherwise done sans incapacitation. With any Financial POA, whether immediate or springing, the agent earns wide discretionary latitude to act on your behalf. This includes managing day-to-day affairs, handling investments, filing taxes, collecting mail, and operating a business. However, you can establish a Financial POA to limit the agent’s power. For example, you may qualify them only to pay monthly bills.

After a Financial POA springs, the person nominated to handle your affairs may do what you would have otherwise done sans incapacitation. After a Financial POA springs, the person nominated to handle your affairs may do what you would have otherwise done sans incapacitation. With any Financial POA, whether immediate or springing, the agent earns wide discretionary latitude to act on your behalf. This includes managing day-to-day affairs, handling investments, filing taxes, collecting mail, and operating a business. However, you can establish a Financial POA to limit the agent’s power. For example, you may qualify them only to pay monthly bills.

Financial POA

A Financial POA remains an important estate planning document. For peace of mind, discuss this option with your attorney. We can walk you through estate planning documents to make sure you select the right people to manage your affairs if you remain alive but are unable to care for yourself.

About Skvarna Law in Glendora & Upland, California

Skvarna Law Firm operates offices in Glendora and Upland, California. Also, we provide legal services. We cover San Bernardino, Los Angeles, Orange, and Riverside Counties. This includes several cities. Upland, Ontario, Rancho Cucamonga, Fontana, Colton, Rialto, Chino, Chino Hills, Glendora, Claremont, Pomona, La Verne, Montclair, San Dimas, Azusa, Covina, West Covina, Diamond Bar, Walnut, La Puente, Corona, Norco & Mira Loma.