October is Special Needs Planning Month. To honor the event, let’s examine planning for disabled people. Plan so they live their best lives. Carefully manage family money to fit the disability-benefit rules. Also, provide additional perks for the disabled person. Finally, through strict rules, permit disabled people to exercise autonomy over some of the money for their personal use. However, simultaneously retain valuable benefits in the plan. This is particularly important for the disabled who formerly worked.

Social Security Deductions

Some people contributed to Social Security deductions but no longer work due to disability. The government pays such people $1,000 (or so) benefits monthly. Other options for coverage include Medicare and Social Security Disability Income (SSDI). This program permits the disabled to collect income from any source while maintaining benefit eligibility. This is, as long as that secondary income is not for employment. Instead, the disabled person can collect from investments or inheritances.

Special Needs Long Term Care

If a family-member qualifies for this type of coverage, they may wonder about qualifying for long-term care Medicare (or Medicaid) benefits. The elders’ funds may funnel into an Irrevocable Trust to benefit the SSDI recipient. When this occurs, the member incurs no penalty for such a gift. This applies even if the elder collects during the five-year Medicaid “look-back” period.

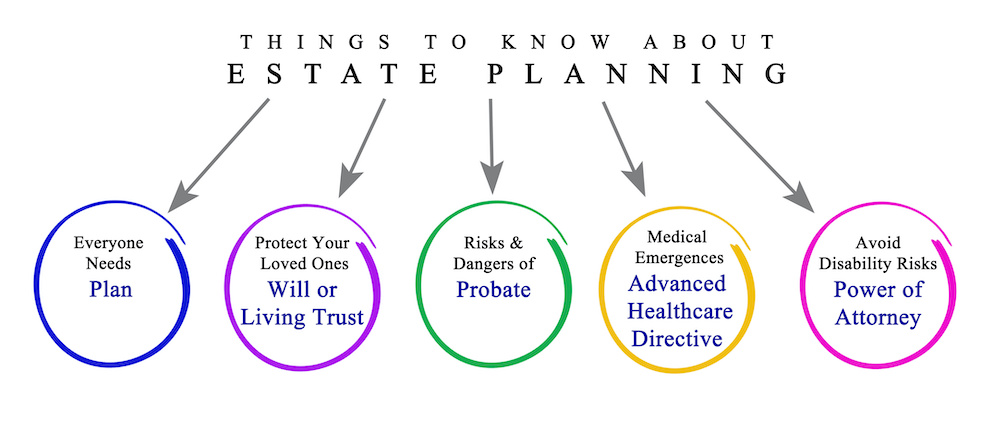

Supplemental Security Income (SSI)

This strategy preserves many thousands of family dollars. Thus, it benefits the impoverished disabled. This program is called Supplemental Security Income (SSI). It provides for people’s basic needs like food, shelter, and medical care. Under the plan, SSI pays an average $800 monthly (plus Medicaid coverage and Section 8 housing assistance). These benefits apply to disabled people, who have not worked nor contributed to the Social Security system. Also, it applies to someone who owns no more than $2,000.

Special Needs Financial Planning

Carefully plan income earned under SSI to preserve benefits. Doing so is worthwhile. For example, medical benefits remain especially important. SSI rules are fairly complicated. Gifts of the “wrong” kind – even simply stocking a disabled family-member’s freezer – could force the recipient to lose or face a reduction of benefits.

Childhood Disability Benefits

Young people who became disabled before turning 22 may qualify for another program. Comparable to SSI, the Childhood Disability Benefits program resembles SSI as far as rules. However, additional wrinkles emerge relative to their parents’ Social Security status.

About Skvarna Law in Glendora & Upland, California

Skvarna Law Firm operates offices in Glendora and Upland, California. Also, we provide legal services. We cover San Bernardino, Los Angeles, Orange, and Riverside Counties. This includes several cities. Upland, Ontario, Rancho Cucamonga, Fontana, Colton, Rialto, Chino, Chino Hills, Glendora, Claremont, Pomona, La Verne, Montclair, San Dimas, Azusa, Covina, West Covina, Diamond Bar, Walnut, La Puente, Corona, Norco & Mira Loma.