One in five American adults suffers some form of mental illness. These people need guidance from an expert. What’s more, they should seek assistance from a professional who can help them prepare for the future.

Mental Health Awareness

You or someone in your family likely struggles with a mental health condition. Rather than ignoring an uncomfortable topic, think proactively about the challenges of living with mental illness. Also, set up an estate plan that directly addresses associated challenges.

Mental Health & Estate Planning

Estate planning is a sensitive subject. This is truer still when the issue of emotional health factors in. If you need to set up or revise an estate plan based around mental health concerns, we can help. Contact our office to set up an appointment with an estate planning attorney today.

Nearly 50 Million Americans Suffer from Mental Illness

Americans face myriad mental health crises. In fact, the National Alliance on Mental Illness reports that 20 percent of U.S. adults experience mental illness. This includes 1 in 20 who experience serious mental illness, and 17 percent of American youth experience a mental health disorder.

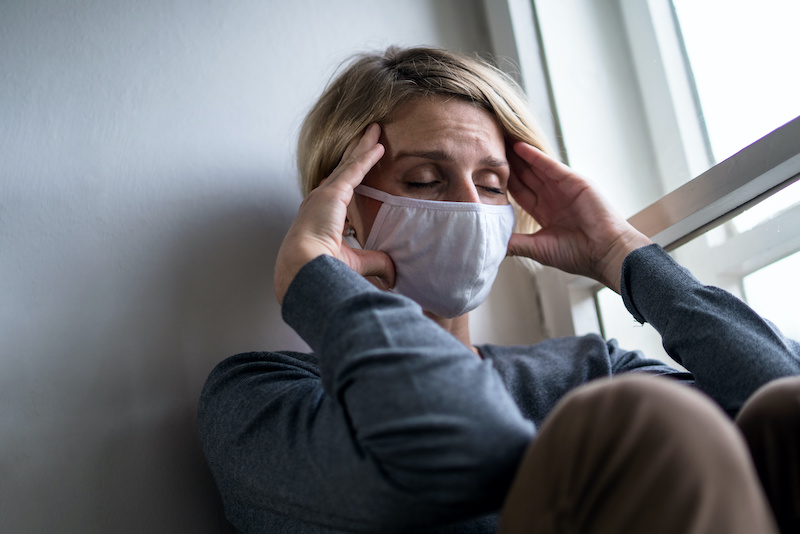

Coronavirus & Mental Health

The mental health crisis worsened during the coronavirus pandemic. Mental Health America asserts that loneliness and isolation fueled increases in anxiety, depression, and thoughts of self-harm. More people seek mental health screening and treatment these days. However, 23 percent of Americans with mental illness do not receive necessary services. Improvement begins once you acknowledge the problem. Talk to a healthcare professional about mental health struggles and treatment options. Doing so leads to better outcomes. One improved outcome may be creating an estate plan that takes into account your own, or a family member’s, mental health.

Your Mental Health and Your Estate Plan

Every estate plan should fit the individual’s needs and their unique family dynamics. Did you know that several estate planning documents address concerns about mental health? Chief among such concerns is the possibility that, at some point, you may not be able to manage your own affairs. To prepare for such a contingency, consider creating and storing the following documents:

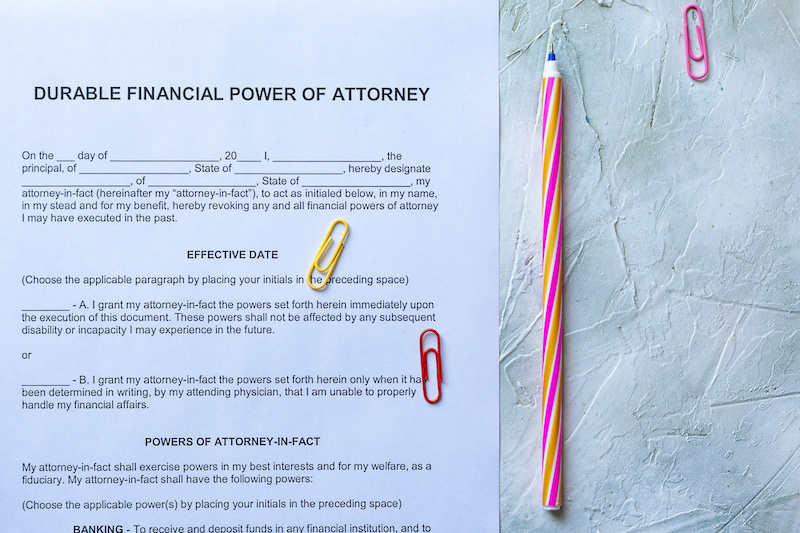

Financial Power of Attorney (POA)

A financial POA enables you to appoint somebody else to manage finances on your behalf. For example, they can manage your bank accounts or sign papers at a real estate closing. The document may take effect immediately or only upon the occurrence of a future event (such as your incapacitation).

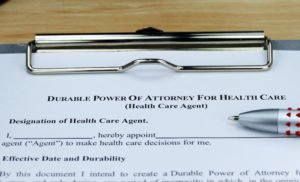

Medical POA

A medical POA grants someone the legal authority to make decisions about your medical care when you no longer can. You have the discretion to limit the kinds of decisions that your chosen representative may make.

Revocable Living Trust (RLT)

A revocable living trust contains money and property. You transfer assets into it. Then, you choose a person (the trustee) to manage it while you live. You can set up a living trust so it can be changed or revoked unless you do not possess the mental capacity to manage it or if you die. A living trust specifies distribution of the money and property when you die.

A revocable living trust contains money and property. You transfer assets into it. Then, you choose a person (the trustee) to manage it while you live. You can set up a living trust so it can be changed or revoked unless you do not possess the mental capacity to manage it or if you die. A living trust specifies distribution of the money and property when you die.

For these documents to confer legal authority, you must possess mental capacity when you sign them. To ensure capacity, seek a professional opinion from a licensed mental health provider. They must state that you are of sound mind and that you understand the meaning and effect of the documents. Alleging lack of capacity can lead to estate plan contestation.

Note: If you entrust someone with POA authority, and that person has mental health concerns, discuss the issue with your family as well as your estate planning attorney.

About Skvarna Law in Glendora & Upland, California

Skvarna Law Firm operates offices in Glendora and Upland, California. Also, we provide legal services. We cover San Bernardino, Los Angeles, Orange, and Riverside Counties. This includes several cities. Upland, Ontario, Rancho Cucamonga, Fontana, Colton, Rialto, Chino, Chino Hills, Glendora, Claremont, Pomona, La Verne, Montclair, San Dimas, Azusa, Covina, West Covina, Diamond Bar, Walnut, La Puente, Corona, Norco & Mira Loma.