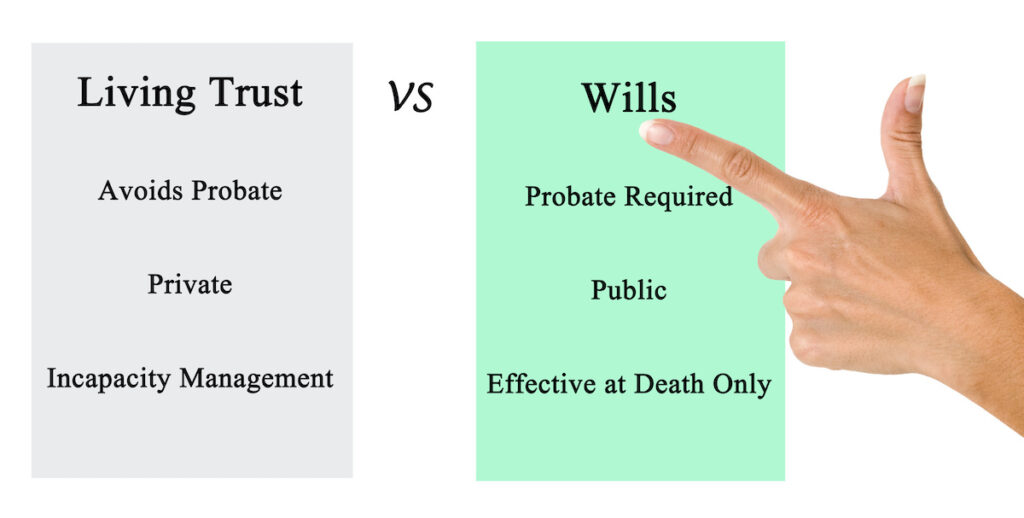

Which one do you need? A Will or Trust? Every adult needs a will, a trust, or both. These essential estate planning control your legacy. Further, they make sure your loved ones are cared for. And, finally, they provide peace of mind that your wishes won’t be left to chance. A properly drafted trust can […]

Category Archives: Wills

Deployment on the Horizon? What You Need to Do to Get Your Affairs in Order In recent posts, we’ve discussed how estate planning can support families during life transitions such as marriage, parenthood, or divorce. This week, we focus on military personnel. Specifically, we cover which legal and planning steps to take before a deployment, […]

Are you looking to secure your family’s future and protect your hard-earned assets? Skvarna Law Firm stands as your trusted partner in estate planning, offering expert asset protection. With offices strategically located in Glendora and Upland, we bring a wealth of experience and local knowledge to help you navigate the complexities of estate planning in […]

Congratulations! You are now legally an adult. Although you may not feel any different, from a legal standpoint, a great deal has changed. When you were a minor (under age 18), your parents were your legal guardians responsible for making all your decisions. Now that you are an adult, their legal authority over you is […]

The legally valid written instructions that a person creates describing how they want their money and property distributed upon their death. Wills are highly recommended, but there is no legal requirement to have one. To make a will legally valid, it must be properly executed in accordance with state law. Executing a will involves signing the document in front of witnesses. Additionally, at the time of signing, the creator must have capacity (i.e., be of sound mind).

To avoid any unnecessary complications in the settling of your affairs, take care to avoid ambiguous or unclear language in your will. If there are any doubts about your last wishes, the executor and beneficiaries may wish to consult with an estate planning lawyer to discuss next steps.

Christmas and birthday gifts can leave lasting impressions on your grandchildren, but you may want to provide them with a gift that can assist them in building a savings account, furthering their education, or purchasing their first home, to name just a few. We hope this information will assist you in analyzing the important details of making a gift that can often be overlooked.

A last will and testament provides instructions about who should receive a person’s money and property when they die.

In addition to asset distribution, your executor makes a public notice of your death, files your final taxes, and records your will in probate court.

When choosing trusted decision makers, select individuals based on their strengths. In other words, consider which characteristics or traits each decision-making role requires.