People mistakenly believe that asset protection only matters for wealthy families or professionals in high-risk occupations. But this is not the case. Anyone can be sued as a result of a car accident, foreclosure, unpaid medical bills, or tenant injury. A monetary judgment against you could decimate your finances.

People mistakenly believe that asset protection only matters for wealthy families or professionals in high-risk occupations. But this is not the case. Anyone can be sued as a result of a car accident, foreclosure, unpaid medical bills, or tenant injury. A monetary judgment against you could decimate your finances.

What Is Asset Protection Planning?

Asset protection planning is the use of legal structures and strategies to safeguard property creditors could snatch away. Protect yourself to keep assets safe from a creditor’s long reach.

Unfortunately, asset protection planning does not provide a quick fix for existing legal problems. In fact, a judge could rule that transferring assets to shield them from existing creditors equates to a fraudulent transfer. If that occurs, you could incur hefty legal penalties. Instead, put an asset protection plan in place before imminent lawsuits. Now is the time to consider implementing one or more of the following asset-protection planning tips.

How to protect your assets from creditors, predators, and lawsuits

Asset Protection Tip #1 – Load Up on Liability Insurance

Asset Protection Tip #1 – Load Up on Liability Insurance

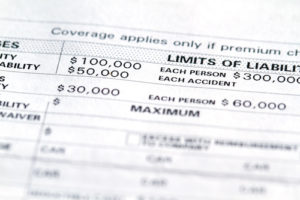

The first line of defense is insurance, including homeowner’s, automobile, business, professional, malpractice, long-term care, and umbrella policies. Liability insurance provides a means to pay money damages. It often includes payment of all or part of the legal fees associated with a lawsuit. Do you have an umbrella policy? If not, now is the time to get one. Doing so is relatively inexpensive. Granted, more advanced ways to protect your assets exist. But they also cost more. Check your current insurance policies to determine policy limits. Make sure they are in line with your net worth. Make adjustments as appropriate. Then, review all of your policies on an annual basis. Confirm that the coverage remains adequate. Also, make sure benefits have not been stripped to maintain the same premiums.

Asset Protection Tip #2 – Maximize Contributions to Your 401(k) or IRA

Under federal law, tax-favored retirement accounts, including 401(k)s and IRAs (but excluding inherited IRAs), are protected from creditors in bankruptcy (with certain limitations). Therefore, maximizing contributions to your company’s 401(k) plan is not only a smart way to increase your retirement savings, but it will also safeguard the investments from creditors, predators, and lawsuits. On the other hand, if your company does not offer a 401(k) plan, then start investing in an IRA for the same reasons.

Asset Protection Tip #3 – Move Rental or Investment Real Estate into an LLC

Asset Protection Tip #3 – Move Rental or Investment Real Estate into an LLC

If you are a landlord or a real estate flipper or investor, then aside from having good liability insurance, moving your real estate into a limited liability company (LLC) can be a great way to help protect your assets from creditors, predators, and lawsuits. There are two types of liability that you should be concerned about with rental or investment property: (1) inside liability (where the rental or investment property is the source of the liability, like a slip and fall on the property, and the creditor wants to seize an LLC member’s personal assets) and (2) outside liability (where the creditor of an LLC owner wants to seize LLC assets to satisfy the member’s debt).

LLC Details

An LLC will limit your inside liability related to the real estate, such as a slip and fall accident or a fire caused by faulty wiring, to the value of the property. In addition, in many states, the outside creditor of the member of an LLC cannot get their hands on the member’s ownership interest in the company (in some states, this will only work for multi-member LLCs, while in others, it will also work for a single member LLC). At a maximum, the outside creditor would only be entitled to the member’s share of the distributions and would have no voting or management rights.This type of outside creditor protection is often referred to as “charging order” protection. This means that if properly protected, a creditor will have to look to your liability insurance and any unprotected assets to collect on their claim, not the LLC.

If you are interested in asset protection planning for your investment real estate using an LLC, then you will need to work with an attorney who understands the LLC laws of the state where your property is located to insure that your LLC will protect you from both inside and outside liability.

You have worked hard to accumulate the assets you have. Don’t let a lawsuit take it all away from you. Give us a call today so we can evaluate your situation and craft an asset protection plan that best serves you and your family.

About Skvarna Law Firm in Glendora and Upland, California

About Skvarna Law Firm in Glendora and Upland, California

A skilled attorney can assist with your estate plan. Contact us today to learn about your options (909) 608-7671. We operate offices in Glendora and Upland, California. We provide legal services for individuals living in San Bernardino, Los Angeles, Orange and Riverside Counties. This includes the cities of Upland, Ontario, Rancho Cucamonga, Fontana, Colton, Rialto, Chino, Chino Hills, Glendora, Claremont, Montclair, Pomona, La Verne, San Dimas, Azusa, Covina, West Covina, Diamond Bar, Walnut, La Puente, Corona, Norco & Mira Loma. Visit SkvarnaLaw.com to learn more.