The legally valid written instructions that a person creates describing how they want their money and property distributed upon their death. Wills are highly recommended, but there is no legal requirement to have one. To make a will legally valid, it must be properly executed in accordance with state law. Executing a will involves signing the document in front of witnesses. Additionally, at the time of signing, the creator must have capacity (i.e., be of sound mind).

An important part of being a responsible business owner includes developing systems to help other people operate the company without you. A business succession plan clearly states who will take over specific roles, hopefully reducing any potential disputes between family members or key employees. If the business is sold after a transition event occurs, a comprehensive business succession plan will also clearly outline the sale price and purchase terms.

Pension and retirement accounts form a large portion of an individual’s wealth. Thus, make sure you account for them in your estate plan. If a retirement account holder completes a proper beneficiary designation, their account assets will bypass probate. Account holders often designate a surviving spouse or children as beneficiary, but they could also name a trust or a charity.

Communication with attorneys is protected by attorney-client privilege, which ensures confidentiality. Most nonlawyers cannot offer the same level of privacy, potentially jeopardizing sensitive information and creating legal risks.

Depending on who your beneficiary is, some options might be a better fit than others. It is important that you understand who your beneficiary is, what their needs are, and what your desired outcome is.

To avoid any unnecessary complications in the settling of your affairs, take care to avoid ambiguous or unclear language in your will. If there are any doubts about your last wishes, the executor and beneficiaries may wish to consult with an estate planning lawyer to discuss next steps.

In movies and television shows, there is often a dramatic scene where family members gather in a lawyer’s office for the reading of the will. The atmosphere is usually tense, and everyone is eagerly waiting to find out who gets what.

One option to financially provide for your pet is to give a lump sum to the person you choose to care for your pet at your death. This option is the easiest to carry out and does not involve any ongoing administration or oversight. However, because the money goes directly to the caregiver, there will be no one monitoring the use of the funds. You must trust that the caregiver will use the funds for the pet’s benefit.

Estate planning can be a complex process and facing it may seem impossible. To make it more manageable, break the process down into smaller, more achievable steps. Identify the first three steps and act.

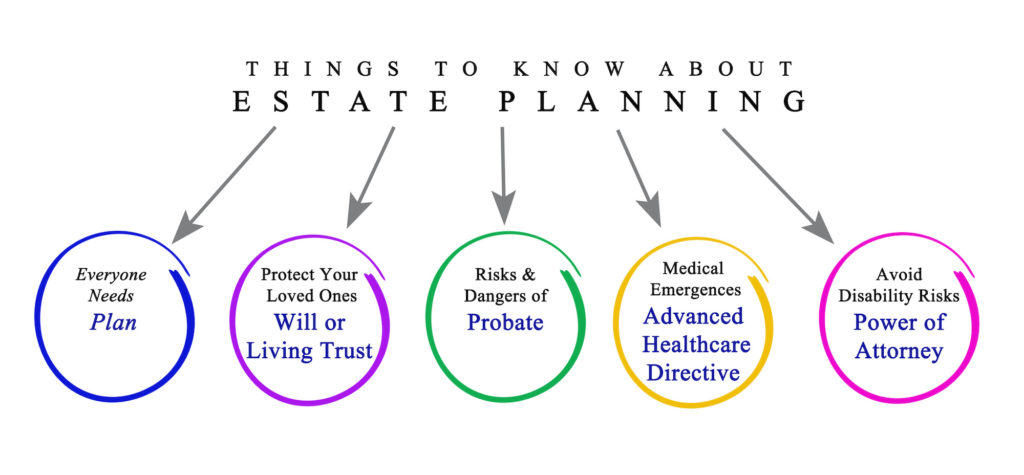

The state may also have to get involved with choosing guardians for your children, authorizing others to act on your behalf, and deciding other important matters. The state’s decisions may be very different than what you would have chosen. In addition, a lengthy probate process can cause delays, increased expenses, and a loss of privacy. Having an up-to-date estate plan makes your wishes known and makes things easier for your loved ones.

As part of the estate planning process, you should discuss with your attorney the role they will play during your lifetime and whether they can also assist your loved ones with estate and trust administration when you pass away.

In other cases, an estate’s liquid assets are not valuable enough to cover the outstanding debt claim. People lose valuable inheritable property and must sell it to cover creditor claims in probate court. A creditor forcing this type of sale extends probate proceedings. This leads to additional costs. Secured creditors receive priority over unsecured creditors. The primary secured creditor is often a bank.

Most people report that managing paperwork relative to the probate process can be a monumental undertaking. This is due to structured timelines and court-imposed deadlines.

When someone is unable to manage his or her own affairs – often due to illness or older age – family members may seek court intervention to appoint a conservator or guardian. The court-appointed individual makes financial decisions on behalf of the incapacitated person. The same person (or sometimes someone different, also appointed by the court) takes over control of everyday matters, including medical decisions. These living probate proceedings are public, time-consuming, and expensive.

It is essential to recognize that the probate system, originally designed to protect property when someone passes away, serves a valuable purpose. So, is there any redeeming value in probate? The answer is a resounding “Yes.” Let’s delve into the pros and cons of probate.

Although a large amount of her wealth came from her marriage to the late billionaire financier Richard C. Blum, Senator Feinstein was also successful in her own right. During their marriage, Feinstein and Blum established a marital trust that is now the subject of a fierce legal battle between Feinstein’s daughter and Blum’s three daughters.

If you are not sure whether an irrevocable trust is still a good fit or if you wonder whether you can benefit more from your trust, we are happy to meet with you so we can analyze your current trust. Perhaps modifying or terminating your irrevocable trust is a good option. Making that determination simply requires a conversation about your goals and a review of the trust itself. Please call our office now to schedule time to review your current trust or discuss the potential benefits that a trust can provide to address your unique situation and goals.

As trust beneficiaries die and younger generations become the new heirs, vague provisions or outright mistakes in the original trust agreement may become apparent. Decanting can be used to correct these problems.

People across the United States use Trust Protectors. Essentially, a trust protector is someone who serves as an appointed authority over a trust which will be in effect for a long period of time. Trust protectors ensure that trustees maintain the integrity of the trust. What’s more, they make solid distribution and investment decisions, and […]

For those who cherish experiences and the creation of lasting memories, it can be invaluable to incorporate clauses within your trust that allocate money specifically for ventures like traveling, exploring new places, or even family reunions and celebrations of important events. These provisions not only facilitate experiences but also foster a deeper connection, ensuring that your family bonds remain strong even in your absence.

A conservatorship is a court-ordered arrangement that gives one person (or multiple people), called a conservator, legal authority to manage the affairs of another person, known as a conservatee or ward. Conservatees are often children. Incapacitated adults and those with developmental or age-related disabilities often enter conservatorship.

Jimmy Buffett died on September 1, 2023, at age 76 after a diagnosis of Merkel cell carcinoma (skin cancer) four years earlier. He was a renowned singer-songwriter, film producer, businessman, novelist, and philanthropist. Buffett released his first album, Down to Earth, in 1970. By 2023, his net worth was $1 billion. This blog discusses the Jimmy Buffet estate.

Some state laws are complex and hard to understand, and you may not know enough specifics to offer the correct information about your situation or verify that AI has properly generated or created your will or trust. Additionally, your final documents may contain wording, formatting, and grammatical errors that make them unenforceable.

In September 2022, Yvon Chouinard, the founder of Patagonia, a $3 billion clothing company, transferred the voting stock of the company to a purpose trust designed to further his lifelong goal of fighting the environmental crisis. In a message from Chouinard on Patagonia’s website, he explained that his desire was for the company to continue to pursue its stated purpose: “We’re in business to save our home planet.”

To mix things up to distribute assets, once everyone has had an opportunity to make their first selection, the person who drew the largest number can start the second round, continuing in reverse sequential order. For the third round, the person who drew number 1 can start, and the selections continue in sequential order.

When to start planning for your estate depends on your goals and the size and complexity of your estate. If your estate involves business interests, multiple properties, significant investments, or complex family dynamics, creating a comprehensive plan may require more time.

When crafting your estate plan, it is important to understand what you have and who you want to leave it to. But you may also want to speak with your beneficiaries before creating your plan to find out if the person you plan to give an item to wants the item, particularly if the item has storage or maintenance requirements that the person will be responsible for.

Christmas and birthday gifts can leave lasting impressions on your grandchildren, but you may want to provide them with a gift that can assist them in building a savings account, furthering their education, or purchasing their first home, to name just a few. We hope this information will assist you in analyzing the important details of making a gift that can often be overlooked.

When someone dies, the outstanding debt fails to disappear. In fact, debt survives the death of the creditor. At that point, the amount owed transfers to the creditor’s estate. In fact, a debt owed to the estate is considered an estate asset. The estate is entitled to collect the debt as part of the probate process.

A husband may move out of the home he shared with his wife and have limited or no contact with her or their children. An abused child who lives with a relative may avoid contact with their parent. A parent may choose not to associate with a child who has committed crimes or abused their trust. These types of situations are unfortunate and occur more often than we would like. Limited contact, or even the absence of any contact, fails to majorly impact the legal right of an estranged spouse or child to inherit from their family member. This is especially true if no estate plan expresses an intention to disinherit them.

When one spouse is the “money person” in the relationship, it can create issues in both life and death. To avoid unnecessary stress, couples need to ensure that they are on the same page. For day-to-day finances, this can mean regular check-ins about charges, expenditures, and budgeting. About estate planning, couples should keep each other informed about the location of important documents such as the following:

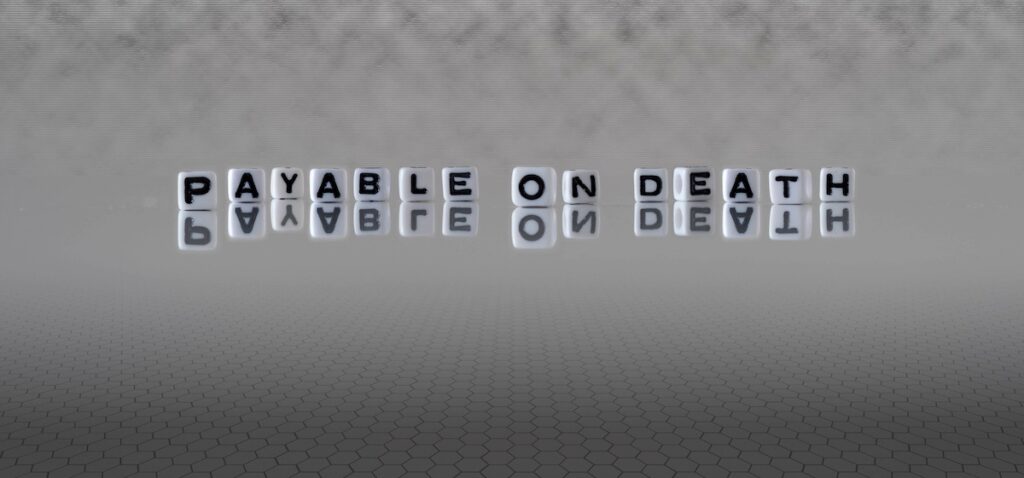

Payable on death and transfer on death sound ominous; and while the topic of death is always somewhat gloomy, POD and TOD are estate planning terms that financial account holders should be familiar with.

The first step is to figure out what accounts the deceased had by looking through their mail, email, or phone notifications. You may get lucky, as the deceased may have compiled a list as part of their estate plan. Once you have identified what accounts were in the deceased’s name, you can move on to the next step of deciding whether to cancel or keep them.

It is understandable why people do not want to talk or think about death. But dying without a will takes power out of the individual’s hands and puts it in the hands of the state and its one-size-fits-all intestacy laws. Here is the law in California, where Skvarna Law Firm is located:

A grantor retained annuity trust (GRAT) is an irrevocable grantor trust you can use to make large financial gifts to your loved ones while also minimizing gift tax liability. These financial gifts remove future appreciation from your estate, reducing the amount that will be subject to estate tax at your death. However, gift tax liability could apply. In this case, the trust creator would pay at the onset. You create a GRAT and then fund it with accounts and property. People expect these to appreciate over the GRAT’s term. Then, you receive a fixed annuity payment, based on the trust’s original value, for a specified time. Once the period ends, the court transfers the remainder of the trust’s accounts and property to your named beneficiary.

Unless someone carefully declutters throughout their entire lifetime, it is unlikely that they will die without possessions. What’s more, when someone struggles at the end of their life with an ailment or age-related decline, they may require certain medical items:

Founded in 1998, PayPal was not the first company to offer online payments, but it was the first to obtain widespread adoption and is the top payment application among Americans today, with around three out of four respondents saying they are active users.

This person is a trusted decision maker who is tasked with handling all matters that relate to your trust. Depending on the type of trust, you could be the trustee in the beginning and need someone else to act as trustee only when you are unable to manage the trust, or you could select a trustee to act immediately.

In more recent years, states simplify probate procedures. For example, the Uniform Probate Code (UPC) consists of laws written by a group of national experts. As such, it helps to standardize and streamline probate. As a result, most states have adopted these standards. Across state lines, the probate process generally works more effectively.

If you are in a long-term relationship with your partner but remain unmarried, you may want to take advantage of these benefits. However, joint trusts do not work for unmarried couples. This may not seem fair. However, there are some important reasons why unmarried couples should consider separate rather than joint trusts.

Seek out resources if you lost your job through no fault of your own. Some employers offer severance packages. And in many cases, you could collect unemployment benefits. Depending on state law and your former employer’s policy, a payout of accrued vacation and sick leave may fund source of liquidity to sustain you for a while.

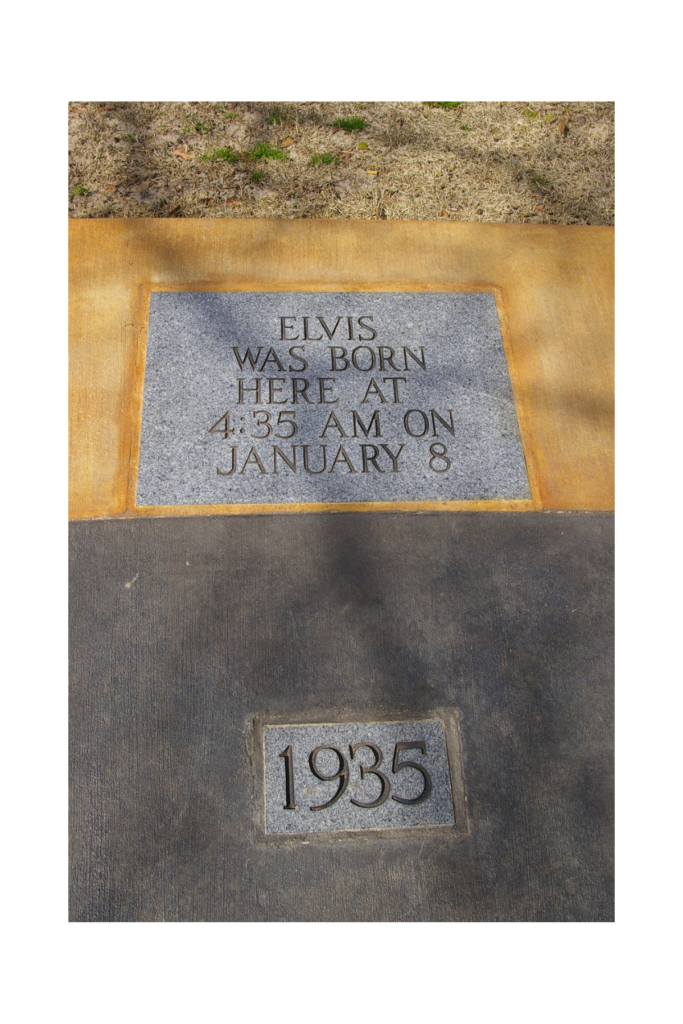

Born in 1968 to Elvis and Priscilla Presley, Lisa Marie followed in the footsteps of her father as far as heart trouble. While her father died from a heart attack at the age of 42, she died due to heart problems nearly 46 years later, in January 2023.

Even as the coronavirus pandemic wanes, many older adults remain socially isolated and vulnerable to financial victimization. Robocalls, emails scams, and catfishing on social media platforms, con artists bombard the elderly routinely seeking financial gain. However, the National Adult Protective Services Association (NAPSA) reports that most financial exploitation cases the organization receives are from individuals known to the victims, such as relatives, caregivers, friends, and neighbors.

Military personnel are entitled to a host of benefits that can significantly impact estate planning. These include pensions, healthcare benefits, survivor benefits, and life insurance programs. These benefits, when properly incorporated into an estate plan, can provide a significant financial safety net for the service member’s family.

Between planning, permitting, and construction, the home remodeling process can take months to complete. But even after the finishing touches have been applied, you may still have work to do. If the home is part of an estate plan, a remodel can affect that plan and require changes to it. To keep your estate plan up to date, make sure to discuss a home remodeling project with an attorney.

When creating your estate plan, decide who to assign as your beneficiaries. These are the individuals who will inherit your money and property when you pass away. Beneficiaries often include a spouse or partner, children and stepchildren, grandchildren, other relatives, friends, charitable organizations, and/or a church.

Raquel Welch had a reported net worth of $40 million. This will presumably go to her two adult children. However, few details reveal Welch’s estate plan. This suggests that she was also savvy about estate planning.

Who would care for your pet if you die or somehow face incapacitation? Would your survivors know how to give your pet the same level of care you provide? A good way to ensure your pet is well cared for if something happens to you is to create a pet trust.

Complex probate processes can be costly and take years to finalize, which is why many individuals retain an estate planning attorney to minimize probate proceedings.

Studies highlight the importance of high-level principles, such as transparency, justice, fairness, and quality of care. Problems arise when there is too much room for interpretation to determine proper and ethical long-term care uses. It’s unclear how AI design in LTC will continue to unfold. We still need more studies evaluating the potential risks and impact of AI technologies used by older adults and their caregivers. Technology is advancing rapidly, but we must take the time to weigh the advantages and disadvantages. Adopting it too quickly and relying on it too heavily initially could have severe consequences.

Although gifts made within three years of your death are generally includible in your estate, an exception exists if a gift tax return was not required to be filed because the value of the gift was less than the annual exclusion amount. Transfers relating to life insurance policies, however, are an exception to this exception.

A last will and testament provides instructions about who should receive a person’s money and property when they die.

Loneliness is feeling sad about a lack of human connections and interactions. While social isolation may make most people feel lonely, loneliness is not the same as being alone. However, not everyone who lives alone feels lonely. What’s more, not all people who feel lonely live alone. People of any age may feel lonely, but the condition is especially common in seniors.

Although starting a business is a significant achievement, small business owners cannot coast on past accomplishments. You must look to the future and plan next steps.

Elder law lawyers may also focus on representing individuals with special needs and their families throughout the process, including attending hearings and communicating with the court. Navigating the legal process can be complex and vary by state. An elder law, disability, or special needs attorney will take all necessary steps and meet all deadlines throughout the legal process.

Aaron Carter failed to achieve the stardom of his older brother Nick. Nevertheless, he succeeded as a performer in his own right. He opened for the Backstreet Boys at age nine.

Do you still own the same property or have the same account balances as when your plan was first created? What will the balances be like at your death?

Parents of a special needs child could purchase life insurance for a child to benefit family caregivers.

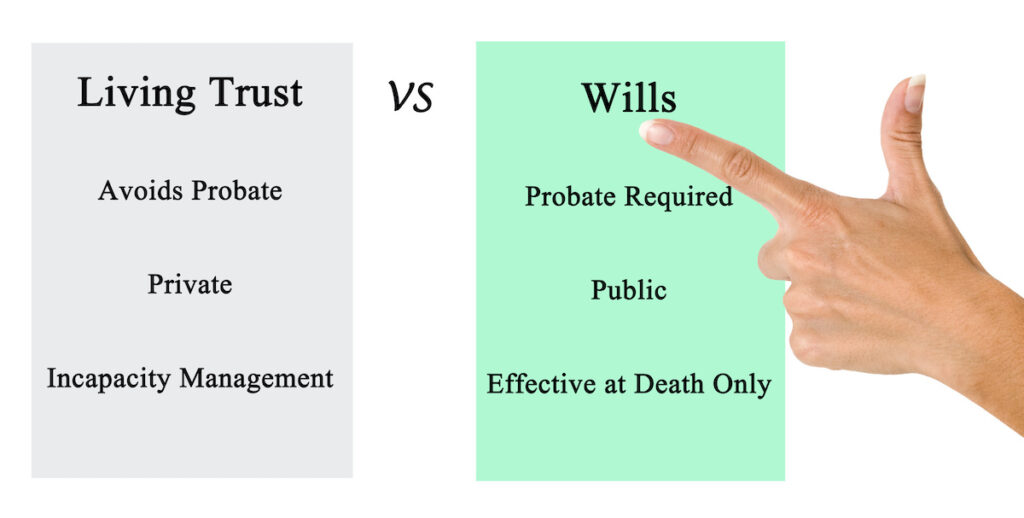

Unlike a will, a trust will help keep your estate from going through an expensive, time-consuming, and public probate process. If you set up a trust, with trustees, you still create a will, but it becomes a pour-over will, which moves (pours) your assets into your trust.

With very few exceptions, state law governs estate administration. So, each state follows unique laws and regulations regarding probate and distribution of a decedent’s assets.

Although these two types of law differ and apply to varying stages in life, many handle them simultaneously. This is because many people wait till later in life to start their estate planning process.

In addition to asset distribution, your executor makes a public notice of your death, files your final taxes, and records your will in probate court.

Educating older adults never to give out financial, government ID, or other personal information over the phone or internet is crucial to protect them. The older you become, the greater the risk of elder fraud. Knowing the possible schemes and planning additional oversight of your financial accounts can help protect your or a loved one from elder fraud. Contact our office to talk with an elder law attorney for resources and help to recover from fraudulent activity.

Paying for long-term care planning remains a significant challenge for most older Americans. However, preparing for service payments often proves tricky.

Before asset distribution, the estate’s executor should make every effort to pay all outstanding debts. After bills are paid, and the remaining assets are accounted for.

The probate process is generally efficient in smaller estates but can become lengthy and complex in larger ones. States have varying probate codes, and many have informal and formal processes.

The key to ensuring that your estate plan will work the way you envision is understanding that how you own your money and property (i.e., how title is held) determines whether your will or trust, or neither, controls who will receive that money and property.

When creating a trust, you can include specific provisions in your trust agreement that will either encourage or discourage certain kinds of behavior.

Normally, somebody in the will specifies an administrator (a person who oversees settling of the estate).

Bruce Wayne possess something key to moonlighting as Batman: money. Heir to an enormous fortune, Wayne emerges as one of Gotham’s wealthiest citizens. A major philanthropist who donates money to various causes, neither role would work without assets.

When people create estate plans, they typically focus on distributing their money and property to loved ones. For those interested in multigenerational wealth transfer, consider dynasty trusts.

The beneficiary of a blind trust also has no knowledge of what goes on with the trust. However, in most cases, the trust-maker is also the beneficiary. That is, the trust contains their personal money and property, and the trustee manages that money and property for the benefit of the trust-maker-beneficiary—the trust-maker-beneficiary just has no knowledge of, or control over, the activities of the trust.

surprised young business woman looking through binoculars on yellow background.

When choosing trusted decision makers, select individuals based on their strengths. In other words, consider which characteristics or traits each decision-making role requires.

The Internal Revenue Service (IRS) describes S corporations as “corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes.”

The news that you will be receiving an inheritance is often bittersweet. Sadly, it means that somebody close to you died. However, you might also have mixed emotions about your inheritance for reasons that have to do with the actual accounts or inherited property.

An annual itemized deduction is available for payment of state and local property, income, and sales taxes. This deduction cannot exceed $10,000, however.

With a nongrantor trust, the trust maker has given up all power over the trust and has no right to any of the trust’s accounts or property. In many circumstances, the trust maker may not even be a trust beneficiary.

Unfortunately, some trustees fail to comply to inform. This leaves beneficiaries in the dark about their trust. The reasons for this failure to communicate vary. Some trustees fail to understand their duties.

n willing (and able) to do what you are asking of them. A complete estate plan includes not only a first choice, but two backups for each of these positions.

A cold wallet is a physical storage device, such as a USB drive. It stores your crypto offline. The downsides of this option include the cost of the hardware, and that the device may be a small object which may easily be misplaced.

Expressing your end-of-life wishes during a family meeting helps ensure that everyone stays on the same page when the time comes.

The first step to protecting your artistic legacy is to catalog your artwork, including pieces you sold. Specify how much to sell each piece for. This information may aid artwork evaluation.

If you live in one of the above states, the debts your spouse incurred during marriage become your debts. As a result, if you cannot repay an insolvent estate, the court could rule you responsible for repayment.

About 80 percent of Americans carry some type of debt. This includes credit cards and student loans as well as mortgage debt and personal loans.

The National Association of Home Builders reports that people owned 7.5 million second homes in 2018. This makes up 5.5 percent of the total number of homes. Such vacation property must be planned for, managed, and maintained. What’s more, they birth happy memories for their owners. Consider these estate planning questions to protect your place […]

Blended families challenge us in life and death. Someone with children from a previous marriage balances wanting to provide for their children and their spouse. Specifically, concerns arise relative to the money left to the current spouse.

Using a bypass trust is another way to avoid the estate tax. In this case, Meat Loaf could have created a trust to hold an amount equal to his unused individual lifetime exclusion amount ($12.06 million), with any excess passing to his wife either outright or through a marital trust, therefore bypassing estate tax liability.

By the time he died, Meat Loaf had appeared in hundreds of TV shows, endearing himself to a younger generation with roles in Wayne’s World and Fight Club. He married twice, and had two children.

Is everything the same today as when you signed your will, trust agreement, and other estate planning documents? If not, then take steps to make sure your estate plan reflects those changes.

Failure to take the time to craft an estate plan could leave the state where you reside at the time of your death in the driver’s seat. Laws in most states set forth how to apportion property.

People overlook many of these tasks and responsibilities on a day-to-day basis. However, consider how much money or time you would need to complete them if the stay-at-home parent is unable?

Many financial institutions allow account holders to sign documents that transfer funds immediately to another person upon the account holder’s death.

Most people prefer to keep this type of information private. So, the best way to ensure discreteness is to keep your estate out of probate.

Your estate attorney can set up joint ownership to create and transfer property. However, this solution comes with its own set of concerns. TOD and POD accounts efficiently and immediately transfer funds to the named recipient after the account owner’s death, outside of probate.

Most people think disability affects other people. However, approximately 61 million U.S. adults live with a disability. That translates to one in four adults. What’s more, between one and four 20-year-olds become disabled before reaching retirement age.

We live in an increasingly digital world now. And courts increasingly determine whether a will created and stored on a computer, tablet, or cell phone and e-signed meets the traditional requirements of being “in writing” and “signed by the will maker.”

People sell most NFTs in an online marketplaces. Some of the more popular NFT marketplaces include OpenSea, Mintable, Nifty Gateway, Rarible, and Zora. Purchase NFTs using cryptocurrency (crypto).

Retiring or stopping your employment means losing one type of income. For many, their retirement accounts will provide a large portion of the money they will be living on during their retirement; however, this does not happen overnight, it takes advance planning.

After a Financial POA springs, the person nominated to handle your affairs may do what you would have otherwise done sans incapacitation.

A key lesson is that no one knows when they will pass away. Even someone as important and well-versed in the law as Abraham Lincoln was caught unprepared for his untimely demise, sadly leaving others to guess what his wishes would have been with respect to his property.

The reasons a trust-maker creates a trust emerge as important. However, your intent or purpose for creating a trust imparts legal ramifications. Therefore, a trust-maker must express (in writing) their intent or purpose for creating the trust.

The trust created often leaves instructions to the trustee. In these, they note that older children earn an advancement from the common trust. They use this to pay for expenses such as buying a home or starting a business.

When you die, your accounts and property pass to minor children in equal shares. However, such money often proves insufficient for individual heir’s expenses.

Whether you filed for Chapter 7 or Chapter 13 bankruptcy, assume that you own less money and property than before the bankruptcy. However, during the bankruptcy process, the court reports certain accounts and pieces of property under a federal or state exemption.

No trust contains unlimited funds or an interminable time horizon. In the end, every trust eventually ends.

If you want someone to continue to manage your Facebook account after you die, you need to designate a legacy contact.

As professional advisors, we spend hours with our clients. In fact, we grow familiar with their most personal details. Listening intently and helping our clients achieve financial and tax planning goals creates a natural closeness between clients and advisors.

Left unaddressed, estate planning myths create serious trouble for loved ones. This often leads to intrafamily conflict, permanently damaged relationships, and lengthy and expensive court battles.

If an accident renders you unable to speak or make decisions for yourself, ask someone to speak on your behalf to doctors and medical providers. A Medical Power of Attorney (POA) allows someone to speak for you and arrange for treatment until you regain consciousness.

Since you spend your time rescuing other people, you may find it difficult to imagine a time when you might need help or rescue.

Rather than ignoring an uncomfortable topic, think proactively about the challenges of living with mental illness.

In most cases, people emphasize the complexities associated with court involvement. Namely, court supervision makes the process of distributing money and property a public proceeding.

A life insurance policy sometimes provides money for continuing care of family members with long-term disabling health conditions.

Planning and asset protection ensures you or your loved one will receive the care they need.

October is Special Needs Planning Month. To honor the event, let’s examine planning for disabled people. Plan so they live their best lives. Carefully manage family money to fit the disability-benefit rules. Also, provide additional perks for the disabled person. Finally, through strict rules, permit disabled people to exercise autonomy over some of the money […]

Unfortunately, despite our best efforts, millions of people misplace wills and trust documents.

The first way to properly prepare to receive an inheritance is to discover what you will be inheriting. Is it real estate, a 401(k), or an individual retirement account (IRA)?

At the time of a death, the legal determinations ensure that the court distributes inheritances in an orderly fashion. Issues may arise during death or divorce depending on whether you live in a community property or separate property state. Based on differing expectations of all parties involved, disagreements may arise.

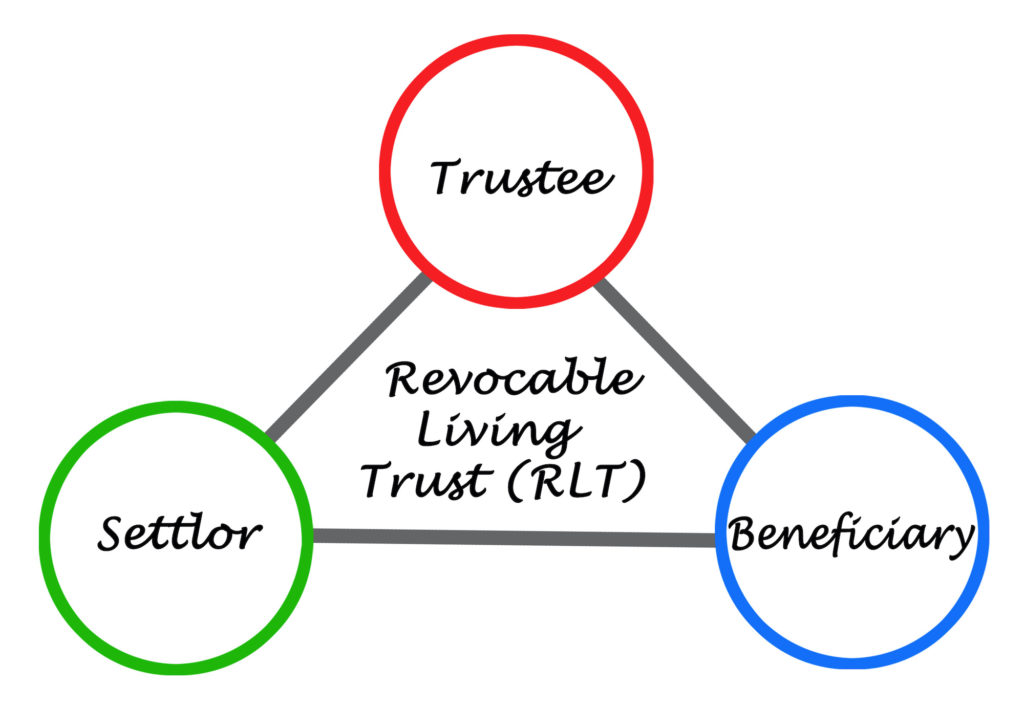

When a married couple (the grantors) uses a joint RLT for estate planning, they also serve as initial trustees of the trust. The grantors then combine their separate property and joint property into the same trust.

Does creating or updating your estate planning seem daunting? If so, this blog addresses common questions senior citizens ask about estate planning.

When elderly parents require more help than an in-home caregiver can provide, we recommend you take the following steps to learn about long term care before committing to relocate your parents.

Depending on your parenting philosophy, decide you you want to treat your children or grandchildren. Treating loved ones equally means that they all receive the same amount.

To help your loved ones avoid this troubling statistic, educate, and update your extended family about wealth transfer goals. Finally, it alerts them to the plan you created to achieve these goals.

The person who was paid must not have been reimbursed by their insurance company. Reimbursed amounts do not qualify for eligibility under the unlimited medical exclusion tax-free gift category.

Planning to Receive an Inheritance Estate planning makes most people think about preparing accounts and property for loved ones. The goals include working in a tax-efficient way. Tax advisors protect clients from probate and disgruntled heirs. Also, they watch out for beneficiaries’ creditors, divorcing spouses, bankruptcy, and more. Finally, they try to prevent poor spending […]

From a practical perspective, the grandchildren’s parents often understand how to use the money for the benefit of their children. What’s more, they may spend or invest it appropriately on their children’s behalf.

If something happens, a successor trustee you previously selected steps in without court involvement. In such a case, they manage the trust on your behalf. You can also designate what happens to the trust’s money and property at your death.

Many estate planning attorneys struggle to formulate a concrete definition of the term. Nevertheless, most estate attorneys define elder law by the demographics they serve — the elderly and the disabled.

Even if Congress fails to act, in 2026, the current rate sunsets. This cuts rates in half to about $6 million per individual. This blog post discusses ILIT Trusts. So, read on.

he SECURE Act drastically decreased which individuals could stretch distributions over their life expectancy.

Medicare Part A over covers the first 20 days of nursing home care.

You can create unlimited profiles. Access to immediate information prepares your trusted agents to immediately answer difficult questions. For example, if you’re in an emergency room the app will provide info to your family members, leading to improved health outcomes. Because you can create as many profiles as you want, use MYLO to store info about yourself, your aging parents, spouse, siblings, children, and friends.

Although you may not own millions, your estate needs a proper legal plan, or an estate lesson plan. Estate is a general term referring to everything you own.

Regardless of why a parent would disinherit a child, they should not disinherit as a tool to manipulate. Disinherited children may feel angry. This could lead to turmoil within the family.

Naming your partner as the pay-on-death (POD) or transfer-on-death (TOD) beneficiary often leads to pitfalls. Some of these occur when you name them on beneficiary designation forms. The POD or TOD option allows you to maintain control of the account during your lifetime.

Making your partner a joint owner iseasy. Simply give them immediate access to and control over an account or property. Keep the account or property owned jointly, with the right of survivorship.

An SRT is a special type of trust. It designates the intended beneficiary of your retirement accounts after you die.

No matter the month, wedding planning usually includes tuxedos, dresses, rehearsal dinners, guest lists, and the honeymoon. However, too many couples fail to consider an important element that should make every “to do” list – a couples estate plan.

An important first step for creating an estate plan? Take an inventory of your money and property. Regardless of your wealth or financial struggles, everything you own is part of your estate and should be listed–or at least accounted for– in your inventory.

Many parents express concern their in-laws becoming outlaws. Their children may divorce. In this case, a divorcing spouse could seize their children’s inherited money and property .

Distressed children often call estate planning attorneys. Their deceased parents wrote a will or a trust without itemizing an inventory. So the kids have no idea which accounts, insurance policies, or items of real and personal property their parent owned.

While many assume that a will or trust signed in an attorney’s office is valid, such is not always the case. Attorneys who do not specialize in estate planning may be unfamiliar with the formalities required to make a will or trust legally valid in their state.

Imagine spending thousands of dollars on an estate plan to protect loved ones, to find that no true protection exists. Unfortunately, this occurs on a regular basis. In fact, millions fall prey to estate planning scams each year. According to a report conducted by the U.S. Consumer Financial Protection Bureau of people ages 50 and over, victims […]

Most people agree that a long life is good. However, life alone does not guarantee ideal circumstances. For example, longevity, coupled with physical or mental incapacity, can prove challenging.

Keep a majority of the details private until your death, Start the conversation with successor trustees.

Healthcare documents (such as a Medical POA, Advanced Directive or Living Will, and Health Insurance Portability and Accountability Act (HIPAA) authorization form) primarily focus on medical matters. However, they may also impact the financial matters handled by the successor trustee.

Unlike other estate planning options, an RLT grants the ability to maintain control and enjoy accounts and property during someone’s lifetime. What’s more, it maintains privacy relative to how to manage accounts and property.

Name someone to serve with you. This familiarizes your co-trustee with your trust. It also teaches your partner about the way you want the trust to operate. What’s more, it lets you evaluate your co-trustee’s abilities.

Busy as ever, many of us supervise kids (in-person or virtually), pursue new employment opportunities and/or adapting to new work environments. What’s more, most of us are adjusting savings and investment goals.

If you plan to refinance a property, call today so we can make sure that your lender, the title company, and you remain on the same page. What’s more, we want to ensure the property you refinance is titled correctly.

Part 1 of a 2-Part Series Low-interest rates led to record-breaking mortgage refinancing across the country. Millions of homeowners are scrambling to refinance their home loans before the end of the year. After all; even a few tenths of a percentage point of interest, paid monthly for 30 years, significantly reduces the amount of interest […]

Everyone eventually dies. To help you make things easier for your loved ones, please call our office to schedule a consultation with one of our experienced attorneys.

Chadwick Boseman died at the age of 43, after a four-year battle with colon cancer. Boseman kept his cancer diagnosis a secret for four years, working on projects such as the Black Panther in the Marvel Comics Avengerfilm franchise.

A financial advisor helps consumers think through long-term financial goals. For example, they may successfully eliminate debt, establish emergency funds, or set up a retirement account.

Exercise offers myriad health benefits. It helps prevent and/or manage health conditions such. These include diabetes, high blood pressure, arthritis, stroke, many types of cancer, and obesity.

After your child dies, remember to update relevant estate planning documents.

Court fees, attorney fees, executor fees, and the cost of probate itself often diminish the value of an estate. The overall costs vary widely from state to state. But the average probate in the U.S. costs between 5 and 10 percent of the value of the estate.

With significant funds in the account, the family may need to file probate to claim the funds. However, most states follow a small estate affidavit process.

Many families purchase life insurance to protect their income. This protects the family’s source of income which would otherwise end due to the death of the parent.

Unfortunately, accidents happen to everyone. Moreover, even innocent accidents could lead to litigation and potential loss of personal wealth. A tool such as a DAPT may protect your property for your family, both now and in the future.

DAPT laws vary significantly by state. Residency requirements vary from state to state, as does the required connection of the grantor with the DAPT state.

Lawyers create testamentary trusts in a will. They write this type of trust upon the individual’s death. Therefore, they do so to protect the money and property on behalf of a beneficiary.

A generation-skipping trusts allows you to distribute your money and property to your grandchildren, or even to later generations, without taxation, by using your lifetime exemption to offset any tax that could be due.

A trust (specifically, a Revocable Living Trust) (RLT) is a formal relationship. In it, the trust-maker names a trusted individual (trustee) to manage accounts and property.

Part 2 in a 2-Part Series Low Interest Rates & Estate Planning Last week, we began a two-part series about how to share your wealth through estate planning. To read part one in the series, click here. This week, we conclude by examining other options for sharing your wealth. We examine charitable gifts, including intrafamily loans.

Your attorney can design the trust to pay the grantor a stream of income at least annually and over a specific term of years. At the end of the specified term, payments end.

Often, family members “lawyer up” and settle in for a long, drawn-out court battle. In such cases, attorney fees often spiral into the tens and even hundreds of thousands of dollars.

Depending on the size of the estate and the nature of the accounts and property held by the estate, these expenses reduce the final amount available for heirs or beneficiaries.

Part 2 in a 2-Part Series Last week, we started a two-part series about how to prepare your estate documents prior to heading out for a summer vacation. Click here to read part one of this series. More documents to gather before heading out for a summer vacation:

(Part 1 of a 2-Part Series) After months of near confinement in our homes, most Americans are stir-crazy. As such, we are eager to travel to make vacation plans. As more states are open, take these precautions before your summer travels.

Or, you could manage their financial affairs as a conservator. This takes time and money. It also involves public testimony and evaluations about your parents’ health and living situation.

After someone you love dies, a court will disperse their money and property either according to their will or to the state’s default distribution scheme. (This is often found in its “intestacy” statute). While most people prefer to manage the settlement process ASAP, the probate process often takes between 18 and 24 months. Yes, you read […]

Today, many people are using Revocable Living Trust (RLTs). Used instead of a will or joint ownership, RLTs provide the foundation of an effective estate plan. When properly prepared, a living trust avoids the public, costly and time-consuming court processes of conservatorship or guardianship (due to incapacity) or probate (after death). Still, many mistakenly send […]

As an added convenience for our clients, we are available to hold our meetings through video conferencing or by phone if you prefer. We are here to help you decide whether it makes sense to avoid probate in your particular case and, if so, the best way to do so.

Most people equate probate with privacy. The process of collecting, managing, and distributing a deceased person’s money and property, probate is not a private process. For example, attorneys file wills at the courthouse. This makes them public record. As a result, your nosy neighbors need only travel to the courthouse or hop online to find out […]

Does the deceased person’s will specify the amount they will pay you? As the personal representative, the estate will award compensation. Amounts vary based on a certain percentage of the estate.

If a hoarder names you as the person to administer his or her estate, follow these suggestions for doing just that.

To better assist our clients, we are available to meet by telephone or video conference. We may also be able to use remote procedures for the signing and executing of your documents, eliminating the need for you to come into our office at all.

Positive emotions accompany by a broadened perspective. This allows us to see and examine a variety of options before choosing the one we believe to be best.

Although most people escape serious danger even with Coronavirus, use the pandemic as a wake-up call create or update your estate plan.

State law may require the new restaurant to meet certain legal requirements to hold a liquor license. This may involve a lengthy process involving a transfer application, a criminal background check, fees, and other measures designed to ensure regulatory compliance.

If you co-own your restaurant with one or more other individuals, it may be beneficial to consider a buy-sell agreement, which is designed to clearly set forth the rights of each of the owners in transferring their interest, making it easier for the owners to exit the business when the time comes.

While you are living, it is your fundamental constitutional right to determine whether–and how often– your children will see your parents (their grandparents).

If you do not appoint the custodian, the court will appoint someone to control and manage your children’s inheritance until they reach a pre-set age of majority. This is necessary because minors legally cannot own money or property on their own.

Supporting a special needs child or grandchild can be expensive. While you are working or have a stream of income, you can allocate money as you see fit.

Part 1 in a 2-Part Series Children bless us. From the day you or your wife gives birth, you start planning for your children’s future. You wonder about their interests, occupation and future spouse. These issues concern families most of the time. What’s more, they emerge as even more important in uncertainty, such as with […]

Some financial articles insist that a will is not the best way to leave assets to heirs. But why is that? Won’t scribbling something on a napkin work? Wills often lead to long and expensive court proceedings. Countless other more-efficient ways could be used, all of which more effectively pass property to family. But follow this […]

Part 3 of a 3-Part Series Last week, in part two of our three-part post about probate-proof estates, we covered one option for avoiding probate with a strategy we called the “Piecemeal Approach.” Click here to read that post. And to catch up by reading part one, which introduced the concept of how to avoid […]

Part 2 of a 3-Part Series Last week, we began a three-part series about probate-proof estates. In part one, we covered reasons you should try to avoid probate. This week, we continue our series by focusing on a strategy we called the “Piecemeal Approach.” Finally, next week, we will conclude the series by delving further […]

The Smartest Way to Make Sure Your Estate Plan is Probate-Proof First in a 3-Part Series Consider this important question: When did you and your estate planning attorney perform a full review of the following? Your long-term plans for your financial affairs Family Legacy? For that matter, have you ever sought out such a review? […]

You can typically disinherit brothers and sisters, nieces and nephews, or even your very own children and grandchildren in your estate plan. However, in California, where Skvarna Law is based, you can’t intentionally disinherit your spouse unless that spouse agrees to waive their rights to your estate in a Prenuptial or Postnuptial Agreement.

If you are like many millennials, who are the first generation who grew up using the internet, you have likely amassed a much greater quantity of digital assets than members of previous generations.

Unfortunately, a startling 79% of millennials admit they never created basic estate plans in place. While your needs and goals may vary, nevertheless, estate plans offer important protection for every adult – including you!

Part 3 of a 3-Part Series Over the past couple of weeks, we examined important things to consider after losing someone to death. To read part one, click here. To read part two, click here. This week, we conclude the series by focusing on paperwork. Cancel benefits Family member recipients of Social Security, veterans, or other benefits […]

Part 2 of a 3-Part Series Estate Safety Considerations Last week, we began a three series about important factors to consider in estate planning after losing someone you love to death. Click here to read part one. This entry, the second in the series, covers ways to make sure the estate remains safe.

Determine which of your loved one’s accounts contains cash that can be accessed for the beneficiaries’ needs and other expenses. The last thing you want is for an item to be repossessed or the electricity turned off due to non-payment.

Along with your financial advisor, we can help determine which of your resources can be used to fund the special needs trust or if a life insurance policy may be needed to ensure that there are sufficient funds available to provide for the beneficiary’s care.

If your adoption is not yet final, but you love the child you intend to adopt and want to provide for him or her, you need to specifically name the child in your estate planning documents.

Most adoptions involve minor children. Arrange for someone to care for the new child if something happens to you. Appoint a guardian, i.e., a caregiver, in your will. This person will act as your child’s parent if you become disabled or die.

If you are an individual with a high net worth, financial planning often moves beyond retirement planning to laying the foundation for multigenerational wealth transfer or achieving philanthropic objectives.

It is important to contact an experienced probate and trust administration attorney to help you with the process, as well as any other legal matters that may arise during this difficult and emotional time.

Make sure that your family members have proper medical powers of attorney and advance directives in place. These documents contain their wishes about how they would like their medical care to be handled if they are not able to make decisions for themselves.

If you are planning to speak to your parents about the need for an estate plan, it is important to try to include any siblings in the discussion to avoid giving the impression that you are trying to influence or control your parents’ choices.

Farming can be a very strenuous and taxing career. Having a medical power of attorney in place is therefore crucial. This document allows you to name an individual to make medical decisions on your behalf in the event you are unable to do so.

Last week, we began a two-part series about designating beneficiaries for your life insurance policy. Click here to read that post. Here is part 2. Protection against your creditors.

Some people mistakenly designate the child’s caretaker as the primary beneficiary, to avoid appointment of a guardian.

College Estate Planning Prep You may have been running around for weeks, getting your new college student off to school. It’s exhilarating, and your heart likely is bursting at the seams. You’re probably prouder than words can express, but you’re also a little afraid, too. How can you make sure your kid is going to […]

Don’t Procrastinate: Talk with Your Family and Your Estate Planning Attorney Today There’s no perfect time to broach the subject of estate planning with your family. We all know that everyone passes away eventually, but many of us often want to conveniently forget that reality. You face a decision. Take the initiative to start a family […]

The loss of a loved one presents unexpected challenges. You might feel overwhelmed if you lose a beloved relative or friend. And the process of handling their affairs only adds to the stress. Many families eagerly try to tie up loose ends and distribute assets. But in many cases, they end up facing either formal […]

You’re not a carbon copy of your neighbor. Likewise, your estate plan shouldn’t be a carbon copy of theirs. A qualified estate planning team tailors trusts to specific needs. Your team works together to produce, tailor, or edit your estate plan. Consider niche trusts.